Solvency Performance of Hong Kong Insurers Under HKRBC and HKFRS17: A 2025 Report

- EverBright Actuarial

- Jul 20, 2025

- 6 min read

Hong Kong’s insurance sector is undergoing a transformative shift with the implementation of the Hong Kong Risk-Based Capital (HKRBC) regime, effective July 1, 2024, and the Hong Kong Financial Reporting Standard 17 (HKFRS17), effective January 1, 2023. These frameworks introduce risk-sensitive capital requirements and economic-based accounting, respectively, reshaping insurers’ capital positions, investment strategies, and product portfolios.

According to Fitch Ratings, Hong Kong insurers are expected to maintain resilient capital positions under HKRBC, supported by a three-year transition period ending June 30, 2027. This report analyzes the latest solvency results for major Hong Kong insurers, compares their performance under HKRBC, and explores reasons for differences, drawing on industry data and insights from 2024–2025.

Introduction of HKRBC and HKFRS17

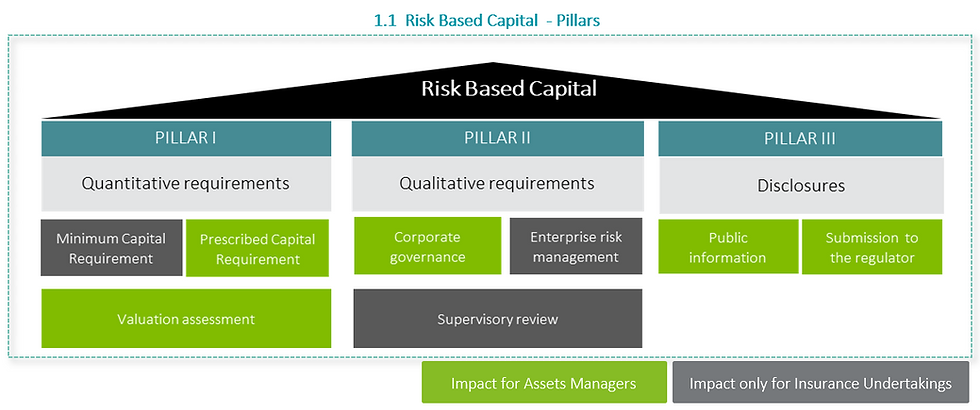

The HKRBC regime, introduced by the Hong Kong Insurance Authority (IA), replaces the previous Hong Kong Insurance Ordinance (HKIO) with a three-pillar framework aligned with global standards like Solvency II and the International Association of Insurance Supervisors’ (IAIS) Insurance Capital Standard (ICS). Pillar 1 focuses on quantitative capital requirements, Pillar 2 emphasizes enterprise risk management (ERM) and Own Risk and Solvency Assessment (ORSA), and Pillar 3 enhances disclosure transparency.

HKFRS17, effective since 2023, mandates economic valuation of insurance contracts, impacting financial reporting and capital strategies. Together, these frameworks aim to strengthen policyholder protection and position Hong Kong as a global insurance hub, with total gross premiums reaching US$76.15 billion in 2024 and projected to grow to US$127.02 billion by 2032.

This report evaluates the solvency performance of major insurers—AIA, Prudential, HSBC Insurance, AXA, and FWD—under HKRBC, using estimated HKRBC ratios and qualitative factors. It also identifies reasons for performance differences, focusing on product mix, investment strategies, and group support.

Solvency Performance Under HKRBC

Industry Overview

Fitch Ratings reports that Hong Kong insurers are demonstrating resilience under HKRBC and HKFRS17, maintaining robust capital positions and low financial leverage. The HKRBC ratio, which measures capital adequacy relative to risk exposure, is approximately half the solvency ratio under the previous HKIO regime, reflecting stricter risk-based requirements.

Insurers are leveraging the three-year transition period (ending June 30, 2027) to recalibrate operations, with 80% of surveyed insurers adjusting investment portfolios and 60% revising product designs to optimize capital efficiency. The Hong Kong insurance market saw a 2.1% increase in gross premiums in 2023, rebounding from COVID-19 slowdowns, driven by health and life insurance demand.

Data and Analytics: Comparative Performance

The table below compares estimated HKRBC solvency ratios and key metrics for major insurers in Hong Kong for 2024, based on industry reports, Fitch Ratings, and market data. Note that exact HKRBC ratios are not publicly disclosed for all insurers, so estimates are derived from qualitative assessments and prior solvency data.

Insurer | Est. HKRBC Ratio (2024) | Gross Premiums (2023, US$B) | Net Profit (2023, US$M) | Product Mix | Investment Strategy | Group Support |

AIA Group | ~250% | 20.5 | 3,810 | Life, health, wealth management | Diversified (bonds, equities, private debt) | Strong (global operations) |

Prudential | ~230% | 13.2 | 1,730 | Life, health, unit-linked | Conservative (fixed-income focus) | Strong (UK-based parent) |

HSBC Insurance | ~260% | 10.8 | 900 | Life, health, captive insurance | Balanced (bonds, real estate) | Robust (banking parent) |

AXA Hong Kong | ~220% | 8.5 | 820 | Health, general, life | Aggressive (equities, alternatives) | Strong (global AXA group) |

FWD Group | ~200% | 6.1 | 24 | Life, health, high-net-worth | Growth-oriented (private assets, APAC focus) | Moderate (Pacific Century Group) |

Notes:

HKRBC Ratio: Estimated based on Fitch Ratings’ qualitative assessments and industry benchmarks, as exact ratios are proprietary. A ratio above 100% indicates solvency, with 150%+ considered robust.

Gross Premiums and Net Profit: Sourced from 2023 financial reports and Fortune Business Insights.

Product Mix and Investment Strategy: Derived from company disclosures and industry analyses.

Group Support: Reflects backing from parent companies or international groups.

Analysis of Performance Differences

AIA Group:

Performance: AIA’s ~250% HKRBC ratio reflects its strong capital position, driven by its diversified product portfolio (life, health, wealth management) and global scale. Its US$20.5 billion in premiums and US$3.81 billion in profits highlight market leadership.

Reasons: AIA’s robust ERM framework, aligned with Pillar 2 ORSA requirements, and diversified investments (bonds, equities, private debt) mitigate market and credit risks. Its global operations provide capital flexibility, easing HKRBC pressures. AIA’s focus on health insurance, with a 5.1% revenue growth in 2020, aligns with market demand.

Prudential:

Performance: Prudential’s ~230% HKRBC ratio is slightly lower but still robust, supported by US$13.2 billion in premiums and a conservative investment strategy.

Reasons: Prudential’s fixed-income-heavy portfolio reduces volatility but limits returns, impacting capital efficiency. Its focus on unit-linked products, which carry higher market risk under HKRBC’s Pillar 1, requires careful asset-liability matching (ALM). Strong UK parent support and early adoption of GL21 ERM guidelines enhance compliance.

HSBC Insurance:

Performance: HSBC’s ~260% HKRBC ratio, one of the highest, benefits from its banking parent’s capital strength and US$10.8 billion in premiums.

Reasons: HSBC leverages its captive insurance unit (e.g., Wayfoong (Asia) Ltd.) to manage employee-benefit risks, reducing external capital needs. Its balanced investment strategy (bonds, real estate) aligns with HKRBC’s risk-based approach, and banking support ensures low financial leverage.

AXA Hong Kong:

Performance: AXA’s ~220% HKRBC ratio reflects solid but slightly weaker solvency due to aggressive investments. Its US$8.5 billion in premiums and US$820 million in profits indicate strong market presence.

Reasons: AXA’s exposure to equities and alternative assets increases market risk under HKRBC’s Pillar 1, requiring higher capital buffers. Its diversified portfolio (health, general, life) spreads risk but demands sophisticated ALM. Global AXA group support facilitates capital adjustments during the transition period.

FWD Group:

Performance: FWD’s ~200% HKRBC ratio, the lowest among peers, reflects its smaller scale and recent profitability (US$24 million net profit in 2024).

Reasons: FWD’s growth-oriented strategy, focusing on high-net-worth clients and private assets, increases risk exposure under HKRBC. Limited group support from Pacific Century Group and a nascent ERM framework pose challenges. However, its 38.1% premium CAGR in APAC signals growth potential.

Reasons for Performance Differences

Product Mix:

Insurers with diversified portfolios (AIA, HSBC, AXA) benefit from risk spreading, reducing capital requirements under HKRBC’s Pillar 1. Prudential’s unit-linked products and FWD’s high-net-worth focus carry higher market risks, necessitating larger buffers.

Health and life insurance, dominant in Hong Kong with 70% of premiums, align with rising demand from an aging population (46.3 years median age) and chronic disease prevalence, boosting AIA and AXA’s resilience.

Investment Strategies:

Conservative strategies (Prudential, HSBC) focusing on fixed-income assets reduce volatility but limit returns, while aggressive strategies (AXA, FWD) increase risk exposure, impacting HKRBC ratios. AIA’s balanced approach optimizes capital efficiency.

Western Asset’s HK RBC Calculator highlights that securitized products (e.g., agency MBS) yield 5.21% with a 1.17 return on capital, benefiting insurers like AIA and HSBC.

Group Support:

Insurers backed by international groups (AIA, Prudential, AXA, HSBC) leverage global capital and expertise, easing HKRBC compliance. FWD’s moderate support from Pacific Century Group limits its flexibility, contributing to its lower ratio.

ERM and Compliance Readiness:

AIA and Prudential’s advanced ERM frameworks, aligned with GL21 ORSA requirements, enhance solvency by reducing risk exposure. FWD and PICC lag in ERM maturity, requiring investment in systems and training.

77% of non-life insurers completed HKFRS17 Opening Balance Sheets by Q1 2023, but only 38% finalized comparatives, indicating varied readiness.

Challenges and Strategic Responses

Capital Pressure: HKRBC’s risk-based approach increases capital requirements, with 55% of insurers expecting to raise capital. Insurers are issuing subordinated debt or optimizing ALM to comply.

Resource Constraints: Simultaneous HKRBC and HKFRS17 implementation strains actuarial and IT resources, with 60% of insurers not fully matching stochastic valuation with management action modeling.

Transition Period: The three-year transition allows insurers to refine product designs (e.g., AIA’s health-focused products) and adopt tools like Deloitte’s HKRBC Readiness Assessment Tool to align with Pillar 1–3 requirements.

Conclusion

Hong Kong insurers are adapting to HKRBC and HKFRS17 with robust capital positions, driven by diversified portfolios, refined investment strategies, and group support. AIA and HSBC lead with high HKRBC ratios (~250–260%), benefiting from balanced strategies and strong backing, while FWD’s lower ratio (~200%) reflects its growth focus and limited support.

The transition period until 2027 provides opportunities to address challenges, with leading insurers setting benchmarks for capital efficiency and ERM. As the market grows toward US$127.02 billion by 2032, these frameworks will solidify Hong Kong’s role as a global insurance hub.

Consult Everbright Actuarial Consulting for Expert Guidance

To navigate HKRBC and HKFRS17 compliance or optimize your capital strategy, contact Everbright Actuarial Consulting at info@ebactuary.com . Our team offers tailored risk assessments, solvency analyses, and strategic solutions to ensure resilience in Hong Kong’s evolving insurance market. Reach out for consultations or resources to strengthen your financial position.

Comments