Report on Asia's Health and Mortality Protection Gaps: A Comparative Analysis

- EverBright Actuarial

- Aug 5, 2025

- 6 min read

Updated: Aug 19, 2025

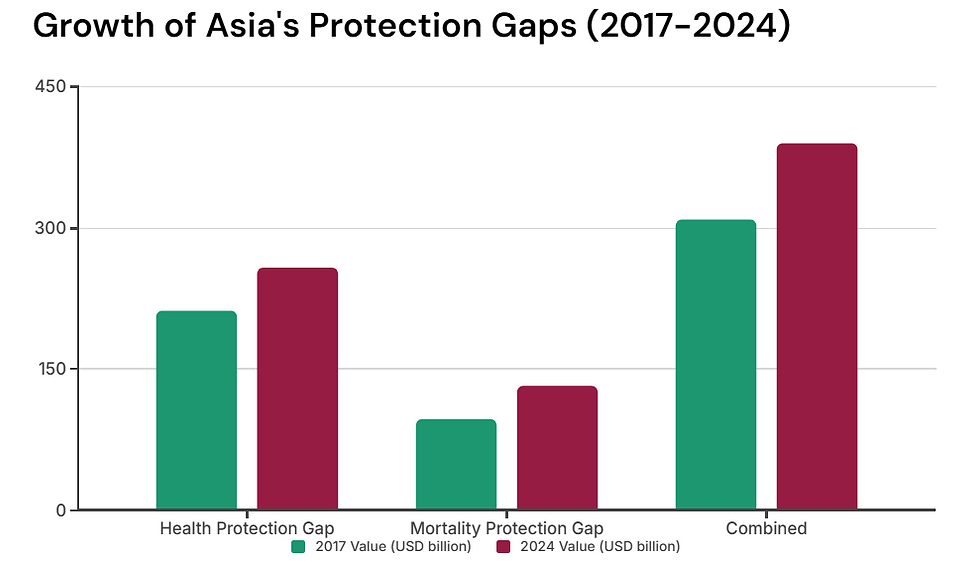

Asia faces a significant underinsurance challenge, with a combined health protection gap (HPG) and mortality protection gap (MPG) reaching $390 billion in premium equivalent terms in 2024. This substantial increase since 2017 is driven by rising medical costs, aging populations, income growth exceeding insurance adoption, and barriers such as pricing concerns and limited consumer understanding.

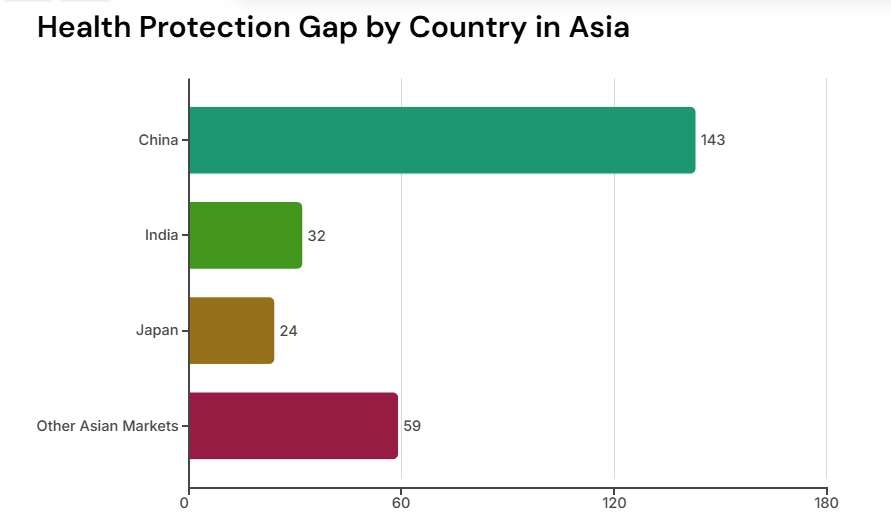

Based on the latest available global figures (2023), Asia accounts for approximately 27% of the global HPG and 32% of the global MPG, highlighting the region's disproportionate vulnerability. Within Asia, China leads the HPG, followed by India and Japan, while emerging markets contribute over 80% of the MPG. These protection gaps present both growth opportunities and potential reputational and financial risks for life and health insurers. Strategies to address this challenge include offering bundled products and promoting preventive services to increase insurance uptake.

1. Overview of Asia's Protection Gaps

Asia's HPG stood at $258 billion in 2024, up 21% from $212 billion in 2017, primarily due to escalating healthcare costs and demographic shifts like ageing populations. The MPG reached $132 billion, a 35% rise from $97 billion in 2017, largely from emerging markets where insurance penetration lags behind economic growth.

A survey of over 12,000 consumers across 12 Asian markets (including China, India, Japan, Indonesia, Thailand, and others) revealed strong demand for life and health insurance, particularly in emerging Asia, but financial stress from out-of-pocket (OOP) spending on chronic and critical illnesses has intensified. Barriers to adoption include high perceived costs, lack of awareness, and economic uncertainty.

Protection Gap Type | 2017 Value (USD billion) | 2024 Value (USD billion) | Growth (%) | Key Drivers |

Health Protection Gap (HPG) | 212 | 258 | 21 | Rising medical costs, ageing populations, increased OOP spending on chronic/critical illnesses |

Mortality Protection Gap (MPG) | 97 | 132 | 35 | Income growth in emerging markets not matched by life insurance uptake, expanding middle class needs |

Combined | 309 | 390 | 26 | Underinsurance in emerging Asia (80%+ of MPG), limited accessibility in markets like India |

2. Comparison with Other Regions

Global data from Swiss Re's sigma Resilience Index 2024 (covering 2023 figures) shows a total protection gap across health, mortality, natural catastrophes, and crop risks at $1.83 trillion in premium equivalent terms, up 3.1% from 2022. Specifically for HPG and MPG, global figures are $941 billion and $414 billion, respectively.

Asia's gaps represent a notable share, but detailed breakdowns for other regions (e.g., Americas, Europe, Middle East and Africa - EMEA) are limited in available reports. However, inferences from global totals suggest that developed regions like North America and Europe have narrower gaps relative to their GDP due to higher insurance penetration and public health systems.

For instance, mortality resilience globally improved to 44.4% in 2023, but declines in Asia-Pacific (driven by China) contrast with stability or gains elsewhere. Emerging regions outside Asia, such as parts of Latin America and Africa, likely face similar challenges but on a smaller scale due to lower economic bases.

Region | Health Protection Gap (USD billion) | Mortality Protection Gap (USD billion) | Combined (USD billion) | Share of Global (%) | Notes |

Asia (12 markets, 2024) | 258 | 132 | 390 | ~29% (of 2023 global total) | High growth in emerging markets; China dominates |

Global Total (2023) | 941 | 414 | 1,355 (HPG + MPG only) | 100% | Includes all regions; grew 5.4% for HPG, flat for MPG |

Rest of World (Inferred, 2023) | 683 | 965 | ~71% | Assumes Asia's share; likely concentrated in Americas (high health costs) and EMEA (ageing in Europe) |

*Data limitations: Regional breakdowns beyond Asia are not explicitly detailed in Swiss Re reports, but Asia's gaps are highlighted as widening faster than global averages due to rapid urbanization and demographic changes.

3. Comparison of Countries' Status in Asia

Within Asia, the HPG is heavily skewed toward populous emerging markets. China accounts for over half ($143 billion), driven by its large population and rising demand for advanced treatments. India follows with $32 billion, exacerbated by non-treatment gaps from affordability and access issues. Japan, an advanced economy, has a smaller $24 billion gap, benefiting from robust public healthcare but facing ageing-related pressures.

For MPG, data is less granular, but emerging markets contribute over 80% ($105.6 billion inferred), with China at approximately $74 billion (2023 figure, likely similar in 2024). Other countries like Indonesia and Thailand show progress via government schemes but still lag in coverage adequacy.

Country | Health Protection Gap (USD billion, 2024) | Mortality Protection Gap (USD billion, ~2024) | Key Status Insights |

China | 143 | ~74 (2023: 73.6) | Largest gaps; narrowing MPG due to increased life insurance, but HPG doubled since 2019 from OOP spending |

India | 32 | Not specified (emerging market share high) | Significant non-treatment gaps; high financial stress from chronic illnesses; low awareness |

Japan | 24 | Not specified (advanced market share low) | Ageing population drives HPG; better penetration but rising costs |

Other Emerging Asia (e.g., Indonesia, Thailand) | Not specified (majority of remainder) | ~32 (inferred from 80% emerging share) | Government expansions help, but uptake limited by economic uncertainty |

Advanced Asia (e.g., Singapore, South Korea) | Not specified (minority) | ~26 (inferred) | Higher resilience; demand for bundled products |

*Inferred values based on regional splits; 12 surveyed markets include advanced (Hong Kong, Japan, Singapore, South Korea, Taiwan) and emerging (China, India, Indonesia, Malaysia, Philippines, Thailand, Vietnam).

Country | Key Status Insights |

Indonesia | Expanded public healthcare schemes reduce gaps but inadequate for chronic conditions; third-largest health gap in terms of unprotected households (older data) |

Thailand | Government expansions help, but uptake limited by economic uncertainty; public schemes address some OOP stress but gaps persist in critical illnesses |

Malaysia | Emerging market with growing middle class; barriers include pricing and awareness; part of broader emerging Asia underinsurance |

Philippines | High demand for insurance but limited penetration; economic uncertainty and OOP costs for chronic care widen gaps |

Vietnam | Rapid income growth outpacing insurance; strong intent to buy in emerging Asia, but awareness and affordability issues |

Hong Kong | Advanced market with higher resilience; cost of living concerns; demand for bundled products; ageing population and high medical costs contribute to gaps, though public systems provide base coverage |

Singapore | High insurance penetration; focus on preventive services; ageing pressures but better coverage than emerging peers |

South Korea | Advanced economy with robust systems; rising medical costs and chronic illnesses; preference for value-added insurance |

Taiwan | Strong public health but ageing demographic increases HPG; demand for life and health bundles |

4. Analysis of Impacts on Different Lines of Business

The protection gaps primarily affect life and health insurance lines, with spillover to reinsurance and broader financial services. Impacts are dual: opportunities for growth amid strong consumer demand (e.g., 60% in emerging Asia intend to buy life insurance soon) and risks from unaddressed vulnerabilities.

Life Insurance (Mortality-Related):

Impact: The $132 billion MPG creates a massive untapped market for term life and whole life products, but low uptake (e.g., <10% in some emerging markets) leads to lost premiums and heightened societal financial instability during events like pandemics. Insurers face reputational risks if families suffer without coverage.

Reasons: Income growth (e.g., expanding middle class) increases protection needs, but barriers like perceived irrelevance and economic uncertainty deter purchases. Over 90% prefer non-pure life policies, favoring bundles.

Business Implications: Positive - Demand for value-added services (e.g., preventive care) can boost sales; Negative - Higher claims volatility if gaps persist.

Health Insurance:

Impact: The $258 billion HPG amplifies financial stress from OOP spending, driving demand for critical illness and medical policies but exposing insurers to adverse selection (e.g., only high-risk buyers). Chronic conditions account for most stress, potentially increasing claims costs.

Reasons: Rising medical inflation (outpacing income in emerging Asia) and ageing (e.g., in Japan/China) widen gaps; limited understanding and pricing concerns hinder uptake. Government schemes in India/Indonesia reduce but don't eliminate gaps.

Business Implications: Positive - Opportunities in bundled L&H products and severity-based designs; Negative - Increased reinsurance needs to manage rising costs; potential for higher premiums alienating consumers.

Other Lines (e.g., Reinsurance, Property/Casualty):

Impact: Indirect; gaps in health/mortality strain household finances, reducing spend on other insurances. Reinsurers like Swiss Re see demand for risk transfer but face broader protection gap pressures (e.g., global $1.83 trillion total).

Reasons: Economic uncertainty (e.g., job security worries) diverts funds from non-essential covers.

Business Implications: Opportunities in holistic products; risks from correlated events (e.g., health crises affecting property claims).

Overall, gaps represent a $390 billion premium opportunity in Asia, but failure to close them could exacerbate inequality and slow industry growth.

5. Reasons Behind the Gaps

Demographic and Economic Factors: Ageing populations and rising incomes increase needs, but insurance lags in emerging Asia.

Cost and Accessibility: High medical inflation and OOP spending (e.g., India) cause stress; pricing barriers top concerns.

Awareness and Product Design: Limited understanding; preference for bundled, relevant products with preventive services.

External Pressures: Economic uncertainty (e.g., cost of living) reduces uptake; government schemes help but are inadequate.

6. Recommendations and Conclusion

It's suggested bundled L&H products, value-added services like preventive care, and improved communication to close gaps. Severity-based insurance could better match needs. In conclusion, Asia's $390 billion gaps highlight urgent underinsurance, larger proportionally than global averages, with China leading country-level challenges. Addressing them via innovation will benefit businesses and societies, reducing financial vulnerabilities.

With a proven track record in Asia's dynamic markets, Everbright offers tailored solutions including advanced risk modeling, product pricing optimization, and gap analysis to design innovative bundled life and health products that align with consumer demands and regulatory landscapes. Our team of seasoned actuaries leverages cutting-edge data analytics and demographic insights to help close protection gaps, enhance resilience, and drive sustainable growth for clients in emerging and advanced economies alike, ensuring comprehensive coverage that reduces out-of-pocket burdens and fosters long-term financial security.

Comments