EVENT INSURANCE:

DEFINITION, COVERAGE, BENEFITS, COST, CLAIMS

Why EverBright?

Best Price Guaranteed

Make a plan; we safeguard your assets with best-price assurance.

Zero stress - Total coverage

We provide end‑to‑end risk assessment, tailored policy placement and proactive claims support.

Tailored Solutions from Experts

Deliver tailored insurance solutions that protect your organisation’s unique exposures.

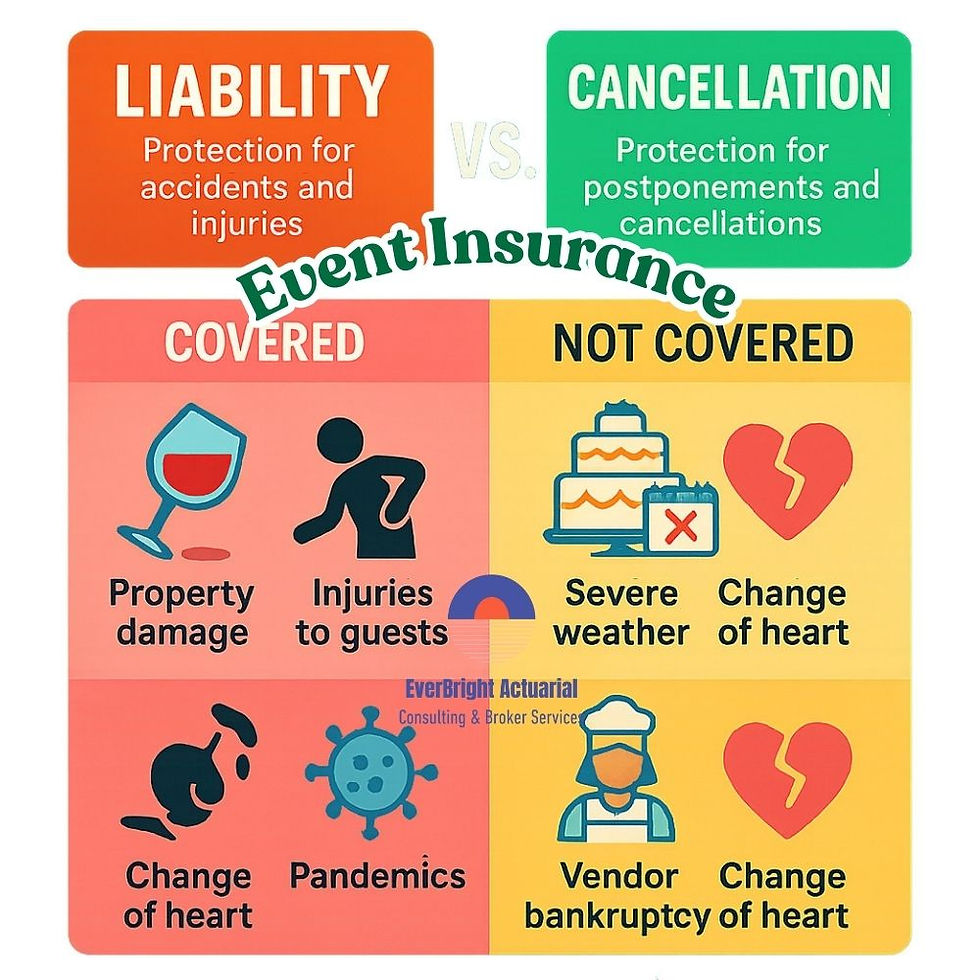

What is event insurance, and what does it typically cover?

Event insurance is a type of coverage designed to protect event organizers, hosts, or vendors from financial losses due to unforeseen incidents during an event. It typically includes:

-

General Liability Insurance: Covers bodily injury, property damage, or personal injury to third parties (e.g., attendees, vendors) caused during the event. For example, if an attendee slips and falls or equipment damages the venue.

-

Event Cancellation Insurance: Reimburses costs (e.g., deposits, vendor fees, or lost revenue) if the event is canceled or postponed due to uncontrollable circumstances like extreme weather, illness, or venue issues.

-

Liquor Liability (if applicable): Covers damages or injuries related to alcohol consumption, often required for events serving alcohol.

-

Property Coverage: Protects event equipment, decorations, or rented items from damage or theft.

What are the Main Exclusions under Event Insurance?

Main exclusions under event insurance policies typically include:

-

Intentional Acts: Damage or injury caused deliberately by the insured or event organizers.

-

Pre-Existing Conditions: Issues or damages that existed before the policy was purchased, such as known venue defects.

-

War or Terrorism: Losses due to acts of war, terrorism, or civil unrest, unless specifically covered.

-

Nuclear or Hazardous Materials: Incidents involving nuclear risks, radiation, or hazardous substances.

-

Non-Covered Perils: Specific risks not listed in the policy, like certain natural disasters (e.g., earthquakes or floods) unless added.

-

Contractual Breaches: Losses from failing to meet contractual obligations, such as vendor disputes.

-

Financial Losses from Poor Attendance: Losses due to low ticket sales or attendance, unless tied to a covered cancellation event.

-

Illegal Activities: Claims arising from illegal activities, such as unpermitted events or serving alcohol to minors.

-

Communicable Diseases: Some policies exclude cancellations or losses due to pandemics or disease outbreaks, though this varies.

-

Wear and Tear: Normal wear or gradual deterioration of equipment or property.

Exclusions depend on the policy and provider, so reviewing the fine print or consulting with an insurer is key to understanding specific limitations.

What are the Key Risks covered under event insurance policy?

Key risks typically covered under an event insurance policy include:

-

Bodily Injury: Injuries to attendees, staff, or third parties during the event, such as slips, falls, or accidents caused by event activities or equipment.

-

Property Damage: Damage to the venue or third-party property caused by the event, like broken furniture or damaged floors.

-

Event Cancellation or Postponement: Financial losses from canceling or postponing an event due to unforeseen circumstances, such as extreme weather, venue unavailability, or key personnel illness, covering costs like deposits, vendor fees, or lost revenue.

-

Liquor Liability: Damages or injuries related to alcohol consumption, such as accidents or fights, if alcohol is served and this coverage is included.

-

Personal and Advertising Injury: Claims from issues like slander, libel, or copyright infringement related to event promotion or activities.

-

Equipment or Property Loss: Damage, theft, or loss of rented or owned event equipment, such as sound systems, decorations, or staging.

-

Medical Payments: Minor medical expenses for injuries at the event, regardless of fault, to avoid larger claims.

What are the Add-On Covers under a Event Insurance Policy?

Add-on covers, also known as endorsements or riders, allow event organizers to customize their event insurance policy to address specific risks not typically included in standard coverage. Below are common add-on covers available under event insurance policies:

-

Liquor Liability Coverage: Protects against claims arising from alcohol-related incidents, such as injuries or damages caused by intoxicated attendees. This is essential for events serving alcohol, especially if the venue or local laws require it.

-

Weather-Related Coverage: Covers losses due to adverse weather conditions (e.g., hurricanes, heavy rain, or snowstorms) that force cancellation or postponement, reimbursing costs like non-refunded deposits or rescheduling fees. Standard policies may exclude certain weather events, so this add-on is critical for outdoor events.

-

Terrorism Coverage: Protects against losses from acts of terrorism, such as cancellations or damages due to a terrorist incident, which are typically excluded in standard policies.

-

Event Equipment Coverage: Extends protection for rented or owned equipment (e.g., audio-visual systems, staging, or decorations) against theft, damage, or loss beyond what’s covered in a standard property damage clause.

-

Non-Appearance Coverage: Covers financial losses if a key performer, speaker, or critical individual (e.g., a celebrity guest or bride/groom for weddings) cannot attend due to illness, injury, or other covered reasons, reimbursing costs like tickets or vendor fees.

-

Specialized Liability for High-Risk Activities: Provides coverage for high-risk event activities, such as fireworks, bounce houses, or extreme sports, which are often excluded from standard liability policies.

-

Cyber Liability Coverage: Protects against losses from data breaches or cyberattacks related to event ticketing systems, online registrations, or digital event platforms, covering costs like data recovery or legal fees.

-

Vendor or Exhibitor Liability: Extends liability coverage to include vendors, exhibitors, or contractors working at the event, ensuring their activities are protected under the policy.

-

Communicable Disease Coverage: Covers cancellations or losses due to outbreaks or pandemics, which are often excluded in standard policies, reimbursing costs if public health restrictions force event changes.

-

Extended Cancellation Coverage: Enhances standard cancellation coverage to include additional scenarios, such as travel disruptions, power outages, or civil authority orders, that may not be covered otherwise.

-

Professional Liability (Errors and Omissions): Covers claims arising from professional mistakes, such as mismanagement or planning errors by the event organizer, that lead to financial loss for clients or attendees.

-

Additional Insured Endorsement: Allows other parties, such as the venue or sponsors, to be added to the policy, ensuring they are protected under the same coverage for event-related claims.

What is the difference between General Liability and Event Insurance?

General Liability Insurance (often called Commercial General Liability or CGL) is a broad, ongoing policy designed for businesses to cover everyday operations against third-party claims. In contrast, Event Insurance (also known as Special Event Insurance) is a tailored, short-term policy specifically for one-off or temporary events, which typically includes general liability as its core component but extends to event-specific risks like cancellations. Here's a breakdown in table form for clarity:

-

Primary Purpose

-

General Liability Insurance: Protects businesses from general third-party claims like bodily injury, property damage, or advertising injury during routine operations (e.g., a slip in a store).

-

Event Insurance: Protects event hosts/organizers from risks tied to a specific event, including liability for injuries/damages plus event-specific issues like cancellations or non-appearance.

-

-

Duration

-

General Liability Insurance: Ongoing annual policy for continuous business activities.

-

Event Insurance: Short-term (e.g., one day to a few weeks), covering only the event date(s) and setup/teardown.

-

-

Core Coverage

-

General Liability Insurance:

-

- Bodily injury to non-employees

-

- Property damage to third parties

-

- Personal/advertising injury (e.g., libel).

-

-

Event Insurance: Includes the same general liability elements, but applied specifically to the event (e.g., guest injury at a wedding or concert). Often starts at $500,000–$1M limits.

-

-

Additional Coverages

-

General Liability Insurance: Typically none for events; may require add-ons for high-risk activities.

-

Event Insurance: Often bundles extras like:

-

- Event cancellation/postponement (reimburses non-refundable costs).

-

- Liquor liability (for alcohol service).

-

- Non-appearance (if a key performer cancels).

-

-

- Vendor/exhibitor extensions.

-

-

Who Needs It

-

General Liability Insurance: Businesses with ongoing operations (e.g., restaurants, contractors).

-

Event Insurance: Vendors at events may need their own general liability.Event hosts/organizers (e.g., weddings, festivals, trade shows). Venues often require it from hosts.

-

-

Cost Factors

-

General Liability Insurance: Based on annual revenue, industry risk, and claims history; averages $400–$1,500/year for small businesses.

-

Event Insurance: Event-specific: $75–$500+ per event, depending on attendance (e.g., $66 for small wedding; $400 for 2,500-person concert), duration, and add-ons like liquor coverage.

-

-

Exclusions

-

General Liability Insurance: Similar base exclusions (e.g., intentional acts, employee injuries), but not tailored to events.

-

Event Insurance: Event-focused exclusions (e.g., pandemics, low attendance unless added); may exclude athletic participants without riders.

-

-

When to Choose

-

General Liability Insurance: For year-round business protection; not sufficient alone for large events.

-

Event Insurance:For one-time events where venues mandate proof of insurance; ideal for risks beyond standard liability.

-

In summary, if your business runs daily, general liability is the foundation. For a specific event, opt for event insurance to get that liability baked in with event-tailored safeguards—it's not a replacement but a specialized extension.

What types of events typically require event insurance?

Event insurance is typically required for a wide range of events to protect organizers, venues, and participants from financial losses due to unforeseen incidents. The need for event insurance often depends on factors like the event's scale, location, activities, and venue or local regulations. Below are common types of events that typically require event insurance:

-

Weddings and Private Celebrations:

-

Events like weddings, anniversaries, or milestone birthday parties often need insurance to cover cancellations (e.g., due to weather or illness), property damage to venues, or injuries to guests. Venues frequently require general liability coverage.

-

-

Corporate Events:

-

Conferences, trade shows, seminars, or company retreats require insurance to cover liability for attendee injuries, damage to rented spaces, or cancellations due to unforeseen issues like speaker no-shows or venue problems.

-

-

Festivals and Fairs:

-

Public events like music festivals, food fairs, or cultural celebrations need coverage for large crowds, vendor activities, alcohol-related risks (if served), and potential cancellations due to weather or other disruptions.

-

-

Concerts and Live Performances:

-

Music concerts, theater productions, or comedy shows require insurance for performer non-appearance, equipment damage, audience injuries, or property damage at venues.

-

-

Sporting Events and Tournaments:

-

Amateur or professional sports events, such as marathons, charity runs, or tournaments, need coverage for participant injuries, equipment damage, or cancellations due to weather or other issues.

-

-

Charity Events and Fundraisers:

-

Galas, auctions, or community fundraisers often require insurance to cover liability for attendees, damage to venues, or losses from cancellations (e.g., if a key sponsor pulls out).

-

-

Exhibitions and Trade Shows:

-

Events with booths, displays, or heavy equipment need coverage for property damage, exhibitor injuries, or cancellations due to unforeseen circumstances.

-

-

Public Gatherings and Parades:

-

Street fairs, parades, or community events require insurance due to large crowds, potential for public injuries, or damage to public property.

-

-

Private Parties with High-Risk Activities:

-

Events with activities like fireworks, bounce houses, or extreme entertainment (e.g., mechanical bulls) often need specialized liability coverage for these high-risk elements.

-

-

Events Serving Alcohol:

-

Any event where alcohol is served, such as receptions, festivals, or corporate parties, typically requires liquor liability insurance to cover alcohol-related incidents, often mandated by venues or local laws.

-

-

Pop-Up Events or Markets:

-

Temporary events like farmers' markets, craft fairs, or pop-up shops need insurance to cover vendor liability, customer injuries, or damage to temporary setups.

-

-

Religious or Community Events:

-

Church gatherings, community picnics, or religious celebrations may require insurance, especially if held at rented venues or involving large groups.

-

-

Film or Photo Shoots:

-

Productions involving crews, equipment, or public spaces often need insurance for equipment damage, crew injuries, or third-party claims.

-

-

School or Educational Events:

-

Proms, graduations, or school fairs require coverage for student and guest safety, property damage, or cancellations, especially if held off-campus.

-

-

Political or Advocacy Events:

-

Rallies, protests, or campaign events may need insurance due to the potential for public disruption, injuries, or property damage.

-

What types of costs can be reimbursed under event insurance in the event of cancellation?

Event cancellation insurance reimburses non-recoverable costs and financial losses when an event is canceled, postponed, or disrupted due to covered reasons (e.g., extreme weather, illness of key participants, venue issues). Below are the typical types of costs that can be reimbursed under event cancellation insurance:

-

Non-Refundable Deposits and Vendor Fees: Payments to vendors like caterers, florists, entertainers, or equipment rental companies that cannot be recovered.

-

Venue Rental Costs: Fees for renting the event space that are non-refunded due to cancellation or postponement.

-

Marketing and Promotional Expenses: Costs for advertising, such as flyers, posters, or digital campaigns, that are unusable due to cancellation.

-

Travel and Accommodation Costs: Non-refunded travel or lodging expenses for key participants (e.g., performers, speakers).

-

Ticket Refunds or Revenue Losses: Refunds owed to ticket holders or lost ticket revenue if included in the policy.

-

Equipment or Setup Costs: Costs for rented or purchased equipment (e.g., sound systems, tents) that are non-refunded.

-

Catering and Food Service Costs: Non-recoverable expenses for food or catering services already contracted.

-

Professional Services Fees: Payments to event planners, photographers, or other professionals that are non-refunded.

-

Rescheduling Expenses: Costs to reschedule the event, like rebooking fees for venues or vendors, if postponement is covered.

-

Loss of Sponsorship or Funding: Financial losses from withdrawn sponsorships or grants due to cancellation, if specified in the policy.

Who is responsible for purchasing event insurance?

The responsibility for purchasing event insurance typically depends on the event’s nature, venue requirements, contracts, and local regulations. Below are the key parties who may be responsible and the factors influencing who takes on this role:

-

Event Organizer/Host:

-

Most Common: In most cases, the event organizer or host (e.g., the individual, company, or organization planning the event) is responsible for purchasing event insurance. This is because they are primarily liable for the event’s operations and risks.

-

Reason: Organizers bear the financial and legal risks of incidents like guest injuries, property damage, or cancellations, making insurance their responsibility to mitigate these risks.

-

-

Venue:

-

Sometimes Required: Some venues require the organizer to provide proof of insurance (often general liability) as a condition of rental. In rare cases, the venue may purchase a blanket event insurance policy and charge organizers a fee to be covered under it.

-

Reason: Venues want protection from damages or lawsuits arising from events held on their property, but they typically pass the responsibility to organizers rather than purchasing it themselves.

-

-

Vendors or Contractors:

-

Occasionally Responsible: Vendors like caterers, entertainers, or equipment rental companies may need their own liability insurance to cover their specific activities. However, the event organizer may still need a policy to cover the overall event.

-

Reason: Vendors are responsible for risks tied to their services, but organizers often need overarching coverage to ensure all aspects of the event are protected.

-

-

Third-Party Event Planners:

-

Possible Responsibility: If a professional event planner is hired, their contract may specify that they arrange insurance on behalf of the organizer. Alternatively, they may advise the organizer to purchase it directly.

-

Reason: Planners may take on this task to streamline logistics or meet venue requirements, but the ultimate responsibility often lies with the organizer unless otherwise agreed.

-

-

Sponsors or Stakeholders:

-

Rare Cases: For large events like festivals or charity galas, sponsors or major stakeholders might contribute to or arrange insurance as part of their involvement, especially if they have a financial stake in the event’s success.

-

Reason: Sponsors may want to ensure their financial contributions are protected against cancellations or liabilities.

-

Key Factors Determining Responsibility:

-

Venue Contracts: Many venues require the organizer to provide a certificate of insurance with specific coverage (e.g., $1M general liability) and name the venue as an additional insured.

-

Event Type: High-risk events (e.g., concerts, sporting events, or those with alcohol) often require the organizer to secure comprehensive coverage, including add-ons like liquor liability.

-

Local Regulations: Some municipalities require event organizers to obtain insurance for public events, especially those involving permits, large crowds, or alcohol.

-

Contractual Agreements: Contracts with vendors, performers, or planners may specify who is responsible for certain types of coverage.

-

Scale and Budget: For small private events (e.g., a backyard party), insurance may not be required unless high-risk elements are involved. Larger events typically necessitate organizer-purchased insurance.

What influences event insurance costs and what's the typical price for a one-day event?

Event insurance premiums are determined by the perceived risk level of the event, which insurers assess based on several key variables. These factors help tailor coverage to the event's specifics, ensuring premiums reflect potential liabilities. Below is a summary of the main influences:

-

Event Type: The nature of the event (e.g., weddings vs. high-energy concerts or sports events). Riskier events with potential for injuries or damages (e.g., festivals with crowds) cost more. Higher for high-risk events like music festivals or sporting tournaments; lower for low-key corporate meetings or private parties.

-

Number of Attendees: Guest count directly correlates with exposure to claims. Events with 50–100 people are cheaper than those with 1,000+.Increases proportionally; e.g., policies for 1,000+ attendees may add 20–50% to the base premium.

-

Location and Venue: Urban venues in high-risk areas (e.g., busy cities) or those with higher foot traffic demand more coverage. Outdoor vs. indoor settings also play a role.Higher in high-risk zones (e.g., coastal areas prone to weather events); rural venues often 10–30% cheaper.

-

Duration: One-day events are baseline; multi-day events (e.g., 2–10 days) adjust pricing, with longer durations increasing costs.Minimal for single-day; e.g., 2–10 days averages $250 vs. $278 for one-day.

-

Alcohol Service: Events serving or selling alcohol require liquor liability add-ons, covering intoxication-related incidents. BYOB is often included in base policies.Adds $50–$150+; mandatory for events like weddings or parties with bars.

-

Coverage Limits and Add-Ons: Base liability (e.g., $1M per occurrence) vs. extras like cancellation, equipment coverage, or weather protection. Higher limits mean higher premiums.Base starts low; add-ons can double costs (e.g., cancellation for weather adds $100–$200).

-

Industry and Risks: Events in entertainment or sports carry inherent risks (e.g., property damage), while corporate events are lower risk. High-contact activities (e.g., bounce houses) require specialized coverage.Entertainment/sports: 20–40% higher; corporate: baseline or lower.

These factors can cause premiums to vary by 50–100% between similar events, so getting quotes from multiple providers is essential.

For a standard one-day event (e.g., a wedding or small corporate gathering with 50–100 attendees and basic liability coverage of $1M), the average cost ranges from $75 to $300, with a median around $278 based on industry data from providers like Insureon and eSportsInsurance. Entry-level policies for low-risk events (e.g., no alcohol) can start as low as $50–$75, while those with add-ons or higher attendance may reach $250–$340. Prices are per event and exclude deductibles (often $0 for liability).

At EverBright Actuarial and Brokerage, we specialize in negotiating the best rates — often 20% lower than market averages — ensuring you get comprehensive coverage at the most competitive price. Let us help you tailor a cost-effective solution.

How to decide the Sum Insured of the Event Insurance Policy?

Deciding the Sum Insured (also called coverage limit) for an event insurance policy involves assessing the potential financial risks and liabilities associated with the event to ensure adequate protection without overpaying for unnecessary coverage. Factors to be considered:

-

Types of Coverage Needed:

-

General Liability: Covers third-party bodily injury, property damage, or personal/advertising injury. Common limits are $1M per occurrence/$2M aggregate (total for the policy period).

-

Event Cancellation: Covers non-recoverable costs (e.g., deposits, vendor fees) if the event is canceled or postponed due to covered reasons.

-

Add-Ons: Includes liquor liability, equipment coverage, weather-related risks, or non-appearance coverage, each requiring its own limit based on risk exposure.

-

-

Assess Event-Specific Risks:

-

Event Type and Activities: High-risk events (e.g., concerts, sporting events, or those with alcohol) may require higher liability limits due to increased chances of injury or damage. Low-risk events (e.g., corporate seminars) may need lower limits.

-

Attendance Size: Larger crowds increase liability exposure. For example, an event with 1,000 attendees may need a $2M liability limit, while 100 attendees might suffice with $1M.

-

Venue Requirements: Many venues mandate minimum liability limits (e.g., $1M per occurrence) and may require being named as an additional insured.

-

-

Calculate Potential Financial Losses:

-

Cancellation Costs: Estimate non-recoverable expenses, such as:

-

Deposits for venues, caterers, entertainers, or equipment rentals.

-

Marketing expenses (e.g., ads, flyers).

-

Travel/accommodation costs for key participants.

-

Ticket refunds or lost revenue (if covered).

-

-

Liability Claims: Consider potential costs of lawsuits or claims for injuries or damages. For instance:

-

Medical costs for an injured guest could range from $5,000 to $50,000+.

-

Property damage to a venue (e.g., broken equipment or floors) could cost $10,000–$100,000+.

-

Standard $1M per occurrence covers most claims, but high-profile events may need $2M–$5M.

-

-

-

Review Venue and Legal Requirements:

-

Venue Contracts: Check if the venue specifies a minimum Sum Insured for liability (e.g., $1M per occurrence is common). Some may require higher limits for larger or riskier events.

-

Local Regulations: Public events (e.g., festivals, parades) may need permits that mandate specific coverage limits, especially if alcohol is served or streets are closed.

-

-

Consider Add-On Coverage Limits:

-

Specific risks like liquor liability, weather-related cancellations, or equipment damage require separate limits. For example:

-

Liquor Liability: $500,000–$1M is common for events serving alcohol, based on attendee numbers and alcohol volume.

-

Equipment Coverage: Match the limit to the replacement value of rented or owned equipment (e.g., $10,000 for sound systems).

-

Non-Appearance: Set the limit based on losses tied to a key person’s absence (e.g., ticket refunds or rescheduling costs).

-

-

-

Evaluate Budget and Risk Tolerance:

-

Cost vs. Coverage: Higher Sum Insured amounts increase premiums. Balance adequate coverage with affordability. For example, a $2M liability limit costs more than $1M but offers greater protection.

-

Risk Tolerance: If your event has high financial exposure (e.g., a large festival with $100,000 in costs), opt for a higher Sum Insured to avoid out-of-pocket expenses. For low-risk events, a lower limit may suffice.

-

-

Consult with an Insurance Provider:

-

Insurers can assess your event’s risk profile and recommend appropriate limits based on industry standards and event details (e.g., size, location, activities).

-

They can also clarify how deductibles or exclusions affect coverage, ensuring the Sum Insured aligns with potential claims.

-

Are weather-related issues covered under standard event insurance policies?

Weather-related issues are typically covered under standard event insurance policies if they are due to sudden and unforeseen natural events such as storms, wind, or rain. Commonly, coverage includes weather events like thunderstorms, hurricanes, heavy rain, or hail that directly impact the event (e.g., venue damage, postponement, or cancellation).

However, many policies exclude coverage for weather-related disruptions caused by gradual, predictable, or ongoing conditions (such as seasonal weather patterns or floodplain flooding unless specifically endorsed).

It's important to review your policy's wording and consult with EverBright Actuarial and Brokerage Services to ensure that weather-related risks are thoroughly covered for your specific event.

What is liquor liability insurance, and when is it required for an event?

Liquor liability insurance is a specialized type of coverage that protects event organizers, hosts, venues, or vendors from financial losses due to alcohol-related incidents at an event. It covers claims arising from injuries, property damage, or other liabilities caused by intoxicated attendees or participants, particularly when alcohol is served, sold, or distributed. This insurance is often an add-on to a general event insurance policy or can be purchased as a standalone policy.

Key Coverages:

-

Bodily Injury: Covers medical expenses, legal fees, or settlements if an intoxicated person injures someone else (e.g., a drunk guest causes a fight or accident).

-

Property Damage: Covers damage caused by an intoxicated individual (e.g., breaking venue property or crashing a vehicle).

-

Legal Defense Costs: Covers attorney fees, court costs, or settlements for lawsuits related to alcohol-related incidents.

-

Personal Injury: May cover claims like slander or defamation if linked to alcohol-fueled behavior, depending on the policy.

Liquor liability insurance is typically required for events where alcohol is served, sold, or distributed, especially in situations involving legal or contractual obligations. Below are the key scenarios when it’s required or recommended:

-

Venue Requirements:

-

Many venues (e.g., banquet halls, hotels, or event centers) mandate liquor liability insurance as a condition of hosting events where alcohol is served. This ensures the venue is protected from alcohol-related claims.

-

-

Local Laws and Regulations:

-

Some states, counties, or municipalities require liquor liability insurance for events serving alcohol, especially public events or those requiring a liquor license or permit.

-

-

Events Serving or Selling Alcohol:

-

Serving Alcohol: If alcohol is provided (e.g., open bar at a corporate event or wedding), liquor liability insurance is often needed to cover risks from overconsumption.

-

Selling Alcohol: Events where alcohol is sold (e.g., cash bar at a fundraiser) typically require this coverage, as selling alcohol increases liability under dram shop laws (which hold servers responsible for overserving).

-

-

High-Risk Events:

-

Events with large crowds, extended alcohol service, or high-alcohol-content beverages (e.g., liquor vs. beer) are more likely to require liquor liability due to increased risk of incidents.

-

-

Caterers or Bartenders:

-

If a caterer or professional bartender is hired to serve alcohol, they may need their own liquor liability insurance, or the event organizer may be required to include them in the policy.

-

How far in advance should event insurance be purchased for an event?

It is generally recommended to purchase event insurance at least 30 to 60 days prior to the event date. This allows sufficient time for policy issuance, review, and the addition of any specific coverage extensions or endorsements needed.

Purchasing early also ensures that you are protected against unforeseen circumstances that could lead to cancellation or postponement, providing peace of mind and comprehensive coverage. For complex or large-scale events, it's advisable to secure insurance even earlier—preferably 2 to 3 months in advance—especially if vendors or venues require proof of coverage.

What is the Claims Process for Event Insurance Policy?

The claims process for an event insurance policy involves a series of steps to report and resolve a claim for covered losses, such as cancellations, liability incidents, or property damage. The process varies slightly by insurer and policy type (e.g., general liability, cancellation, or liquor liability), but the following outlines the typical steps, requirements, and considerations for filing a claim under an event insurance policy.

-

Notify the Insurer Promptly: Contact your insurance provider as soon as possible after the incident (e.g., cancellation, injury, or damage). Most policies require notification within a specific timeframe (e.g., 24–72 hours for liability claims or 7–30 days for cancellations).

-

Use the insurer’s designated claims hotline, online portal, or agent contact information.

-

Provide basic details: policy number, event date, location, and a brief description of the incident.

-

-

Gather Documentation: Collect all necessary evidence to support your claim. The required documentation depends on the claim type.

-

Cancellation Claims:

-

Proof of the covered peril (e.g., weather reports, medical certificates for a key person’s illness, venue closure notices, or government orders).

-

Financial records of non-recoverable costs (e.g., receipts, contracts, or invoices for deposits, vendor fees, marketing expenses, or ticket refunds).

-

Evidence of mitigation efforts (e.g., attempts to reschedule or recover refunds).

-

-

Liability Claims (Bodily Injury/Property Damage):

-

Incident reports or witness statements describing the event (e.g., a guest’s fall or damage to venue property).

-

Photos or videos of the incident scene, injuries, or damages.

-

Medical records or bills for injuries (if applicable).

-

Police or security reports, if involved.

-

Correspondence with affected parties (e.g., a venue demanding repair costs).

-

-

Liquor Liability Claims:

-

Proof of alcohol service (e.g., bartender contracts, liquor permits).

-

Incident details linking the claim to alcohol consumption (e.g., a fight caused by an intoxicated guest).

-

-

-

Complete and Submit the Claim Form: Obtain the insurer’s claim form (available online, via email, or from your agent) and fill it out with accurate details.

-

Cooperate with the Insurer’s Investigation.

-

Mitigate Losses: Take reasonable steps to minimize losses, as most policies require policyholders to mitigate damages.

-

Receive the Claim Decision: The insurer will review the claim and issue a decision, typically within 7–30 days, depending on complexity.

-

Appeal or Dispute (if Necessary)

-

Receive Payment

What Documents are needed to File an Event Insurance Claim?

To file an event insurance claim, you will typically need the following documents:

-

Completed claim form provided by your insurer

-

Proof of event cancellation or postponement (e.g., official notice, venue rejection letter)

-

Evidence of incurred costs or losses (receipts, invoices, contracts)

-

Documentation of the insured event (photos, videos, police reports if applicable)

-

Evidence supporting reasons for claim (e.g., weather reports, supplier notices)

-

Any correspondence with vendors, contractors, or authorities related to the claim

-

Statement detailing the circumstances of the loss or cancellation

Providing clear, organized documentation helps expedite the claims process. To ensure a smooth and efficient experience, consult EverBright Actuarial to assist you with preparing and submitting your claim.

Your Needs, Our Services

We offer free consultations. If you want to learn more, please contact us at info@ebactuary.com or 📞+852 3563 8440. You can also fill out our Contact Form, and we guarantee to get back to you within 24 hours.

Liability Insurance

engineering insurance

Machinery Breakdown

Boiler Pressure Plant

Electronic Equipment

Advance Loss of Profit

Factory and Warehouse

Machinery Loss of Profit

property insurance

Electronic Equipment

Business Interruption

Burglary Insurance

group insurance

Group Travel Insurance

Group Disability Insurance

Supplementary Group Medical

Trade Credit

Student Group Insurance

Marine & Pecuniary

Marine Cargo Insurance

Marine Open Policy

Protection & Indemnity, P&I

Hull & Machinery Insurance

Inland & Warehouse

Motor Insurance

Fine Art & Jewellers

Trade Credit

Individual Line

Health Insurance

Critical Illness

Home & Contents

Life & Private Medical

Inland & Warehouse

Motor Insurance