Unlocking Opportunities: Healthcare Integration in the Greater Bay Area

- Jul 20, 2025

- 4 min read

Updated: Jul 21, 2025

The Greater Bay Area (GBA) is rapidly transforming into a hub of healthcare integration, driven by policy innovation and significant cost disparities between Hong Kong and mainland cities like Shenzhen and Guangzhou.

As outlined in the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area, initiatives like the Elderly Healthcare Voucher GBA Pilot Scheme and cross-border electronic medical records are enhancing access to shared medical resources, improving care continuity, and alleviating pressure on Hong Kong’s strained healthcare system. At EverBright Actuarial Consulting Limited, we explore the current state of GBA healthcare integration, its drivers, and opportunities for insurers and employers, backed by compelling data and real-world insights.

Policy Initiatives Fueling Healthcare Integration in the Greater Bay Area

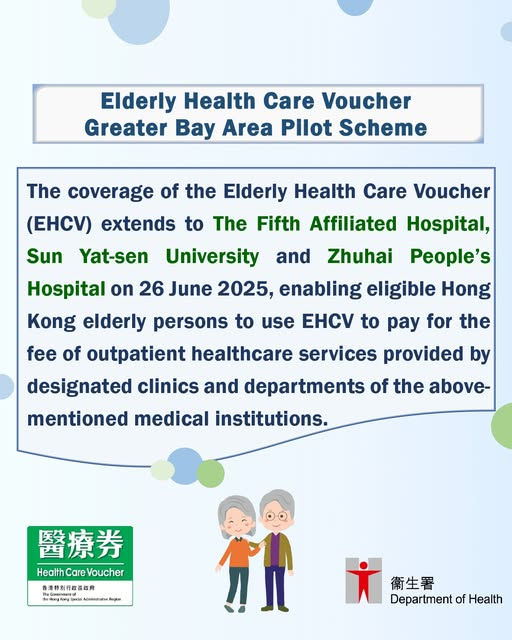

Hong Kong and mainland authorities are implementing robust policies to promote cross-border healthcare. The Elderly Healthcare Voucher GBA Pilot Scheme, as of May 2025, enables eligible Hong Kong seniors to use vouchers for outpatient care at 12 designated GBA medical institutions, reducing reliance on Hong Kong’s private clinics.

The Support Scheme for Hospital Authority Patients in the GBA provides access to mainland public hospitals, easing demand on Hong Kong’s public system. Additionally, the Cross-Border Use of Electronic Medical Records facilitates seamless care by sharing patient data between regions.

Under the Interim Measures for Hong Kong, Macao, and Taiwan Residents, Hong Kong residents in the mainland can enroll in basic medical insurance, such as Shenzhen’s Tier-2 plan (800 RMB/year), offering up to 70% reimbursement for chronic disease treatments at facilities like the University of Hong Kong-Shenzhen Hospital.

Drivers of Healthcare Integration

Three key factors are accelerating GBA healthcare integration:

Population Mobility: Approximately 540,000 Hong Kong permanent residents live long-term in Guangdong Province (2018 estimate), driving demand for mainland medical services. This mobility creates opportunities for insurers to develop cross-border plans catering to this demographic.

Medical Cost Disparities: Mainland GBA cities offer medical services at 10–50% of Hong Kong’s private healthcare costs. For example, hospitalization in Shenzhen’s Grade 3A hospitals costs 330–1,100 HKD/day, compared to 3,000–23,000 HKD/day in Hong Kong’s private wards.

Outpatient fees in Guangzhou’s top-tier hospitals (22–220 HKD) are 10–30% of Hong Kong’s private clinic rates (500–1,500 HKD). Procedures like cataract surgery (5,500–16,500 HKD in Shenzhen vs. 30,000–60,000 HKD in Hong Kong) and biologic injections for eczema (1,100 HKD vs. 3,000–5,000 HKD) highlight significant savings.

Improved Mainland Medical Standards: With 45 Grade 3A hospitals in Guangzhou and Shenzhen, mainland GBA cities offer advanced treatments, such as cancer care and organ transplants, at quality levels increasingly recognized by Hong Kong residents. This has boosted confidence in seeking care across the border.

Cost Comparison: Hong Kong vs. GBA Mainland Cities (2023–2025)

Medical Service | Hong Kong Cost (HKD) | GBA Mainland Cost (HKD) | Cost Difference |

General Consultation | Public: 60–120 (2026) Private: 500–1,500 | 22–660 | 10–30% |

Specialist Consultation | Public: 120–180 (2026) Private: 800–2,500 | 55–880 | 10–35% |

Hospitalization (General Ward, Daily) | Public: 150 (2026) Private: 600–23,000 | 330–5,500 | 20–50% |

Appendectomy | Public: 5,000–10,000 Private: 50,000–100,000 | 11,000–55,000 | 20–50% |

Dental (Teeth Cleaning) | Private: 500–1,500 | 110–880 | 20–30% |

Comprehensive Health Check | Private: 2,000–10,000 | 550–5,500 | 20–50% |

Source: Hong Kong SAR government, mainland hospital data, 2023–2025 estimates.

Real-World Impact and Opportunities

The cost advantage of mainland GBA healthcare is reshaping insurance strategies. For example, a Hong Kong-based SME with 100 employees integrated GBA hospital access into its group medical plan, reducing premium costs by 12% while offering employees affordable outpatient care in Shenzhen.

Similarly, a multinational insurer reported a 15% increase in demand for cross-border health plans in 2024, driven by Hong Kong residents seeking dental and health check-up services in Guangzhou, where costs are 20–30% of Hong Kong’s.

Globally, Singapore’s cross-border medical tourism model, where insurers partner with Malaysian hospitals to lower costs by 30%, offers a blueprint for GBA insurers to develop similar partnerships.

The rise in mental health claims (10% of total claims in Hong Kong, 2024) also presents opportunities. Mainland hospitals, with lower-cost counseling services (220–550 HKD/session vs. 800–2,000 HKD in Hong Kong), can support employers in offering comprehensive mental health benefits.

Additionally, the GBA’s 45 Grade 3A hospitals provide economies of scale for advanced treatments, enabling insurers to negotiate competitive rates for procedures like cancer care, which accounts for 35% of Hong Kong’s inpatient claims.

Challenges and Strategic Considerations

Despite the opportunities, challenges remain. Cross-border insurance plans must navigate regulatory differences, such as varying reimbursement policies and licensing requirements.

Language barriers and cultural differences in medical practices can affect patient trust. Insurers and employers must also ensure seamless claims processing and data privacy for electronic medical records.

To address these, Hong Kong insurers can leverage technology, such as AI-driven claims platforms, which reduced administrative costs by 7% for a US provider in 2024 (Deloitte), or adopt Singapore’s model of standardized cross-border protocols.

Partner with EverBright for GBA Healthcare Solutions

The GBA’s healthcare integration offers immense potential for insurers and employers to optimize costs and enhance employee benefits. EverBright Actuarial Consulting Limited, with our actuarial consulting and licensed brokerage services, is your trusted partner in navigating this dynamic landscape.

Our team designs data-driven cross-border insurance plans that leverage GBA’s cost advantages, integrating access to Grade 3A hospitals, telemedicine, and mental health support. Through our Hong Kong subsidiary, holding Life and General Insurance broker licenses, we offer tailored group medical and bespoke policies to meet your needs.

Since 2014, we’ve empowered businesses to create competitive, cost-effective benefits packages. Contact us at info@ebactuary.com or via our online form to explore how EverBright can help you unlock the opportunities of GBA healthcare integration, delivering value and fostering a healthier workforce.

Comments