APAC Auto Insurance Market Report: Growth, Country Comparisons, and Electric Vehicle Impact (2023–2032)

- EverBright Actuarial

- Jul 26, 2025

- 6 min read

The global auto insurance market was valued at $923.4 billion in 2023 and is projected to reach $2.27 trillion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2024 to 2032, according to Allied Market Research.

The Asia-Pacific (APAC) region is forecast to be the fastest-growing, driven by rising road accidents, digital tool adoption, data generation, and advanced technologies enhancing safety and efficiency.

This report analyzes the APAC auto insurance market, compares key countries including a separate focus on Hong Kong, examines the impact of electric vehicles (EVs) on insurance dynamics, and provides a comparison between the general auto insurance market and the EV-specific segment, including trends.

Market Overview

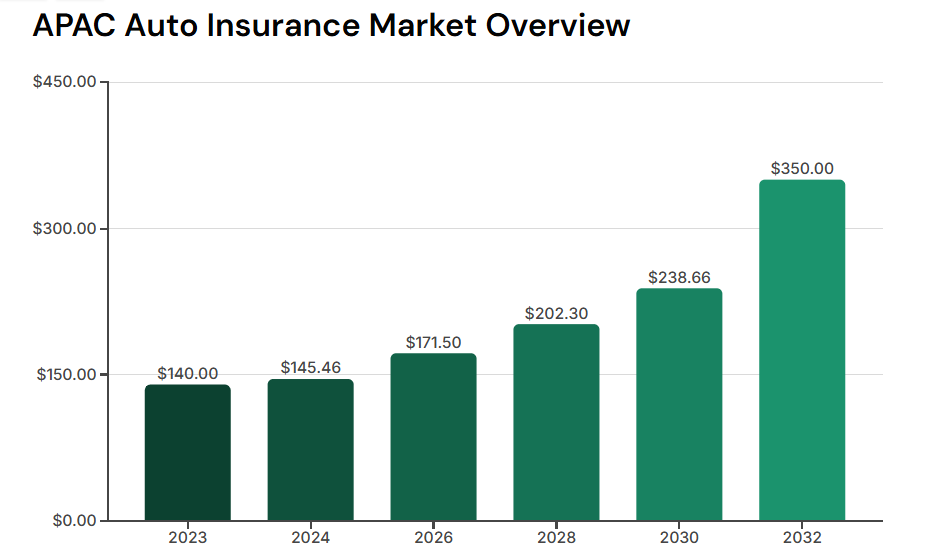

The APAC auto insurance (motor insurance) market is a significant portion of the global market, valued at approximately $145.46 billion in 2024 and projected to reach $238.66 billion by 2030, with a CAGR of 8.6%.

By 2032, projections align with global trends, potentially exceeding $300 billion, supported by increasing vehicle ownership, urbanization, and regulatory mandates for insurance coverage.

Key drivers include the rise in road accidents, digitalization (e.g., usage-based insurance), and integration of telematics for risk assessment. Challenges include fraud, high claims from natural disasters, and economic volatility.

The table below compares the APAC market with the global market.

Metric | Global | APAC |

Market Size (2023) | $923.4 billion | ~$140 billion (est.) |

Market Size (2032) | $2.27 trillion | ~$350 billion (est.) |

CAGR (2024–2032) | 10.8% | 12–14% (fastest region) |

Key Drivers | Road accidents, digital tools | Digital adoption, data generation, safety tech |

(Note: APAC estimates based on 2024 value of $145.46 billion and extended CAGR projections from sources like Allied Market Research and Statista.)

Country Comparisons in APAC

The APAC auto insurance market is diverse, with China dominating due to its large vehicle fleet and mandatory insurance policies. Japan and South Korea have mature markets with high penetration rates, while India and Southeast Asian countries like Indonesia and Malaysia are growing rapidly due to rising middle-class incomes and vehicle sales.

Australia features competitive pricing and telematics adoption. Hong Kong, as a Special Administrative Region, is treated separately due to its unique regulatory environment and high vehicle density in an urban setting.

The table below summarizes available sizes, projections, and CAGRs for key countries, drawn from aggregated sources.

Country/Region | Market Size (2023, USD Billion) | Projected Size (2030/2032, USD Billion) | CAGR (2024–2030/2032) | Key Status and Drivers |

China | ~100 (est.) | ~160 (2030, est.) | 8–10% | Largest market; mandatory coverage, EV boom, digital claims processing. High growth from urbanization. |

Japan | ~40 (est.) | ~55 (2030, est.) | 4–5% | Mature market; high penetration (95%+), focus on disaster coverage. Slower growth due to saturation. |

South Korea | ~20 (est.) | ~30 (2030, est.) | 6–8% | Advanced tech integration; high EV influence, focus on safety features. Stable but innovative market. |

India | ~15 (est.) | ~30 (2032, est.) | 12–15% | Rapid growth; rising vehicle sales, regulatory reforms. Low penetration (70%), potential for digital expansion. |

Australia | ~10 (est.) | ~15 (2030, est.) | 5–7% | Competitive; telematics and usage-based insurance popular. Growth tied to EV adoption and climate risks. |

Thailand | ~6 (est.) | ~10 (2030, est.) | 7–8% | Tourism-driven; flood risks increase claims. Growth from EV subsidies and digital platforms. |

Indonesia | ~5 (est.) | ~12 (2032, est.) | 10–12% | Emerging; growing middle class, vehicle ownership up. Challenges: fraud, low awareness. Part of Southeast Asia's $30.69B in 2023 to $66.55B by 2033 (CAGR 8.2%). |

Malaysia | ~4 (est.) | ~8 (2030, est.) | 8–9% | Regulatory changes; EV incentives boosting demand. Integrated with auto financing. |

Singapore | ~2 (est.) | ~3.5 (2030, est.) | 8% | High penetration; digital tools dominant, cross-border coverage with Malaysia. Urban-focused. |

Hong Kong | ~1.0 (est.) | ~1.5 (2030, est.) | 5–7% | Urban market; high penetration, focus on third-party liability. Growth driven by vehicle ownership rise (108,674 motorcycles in 2023, up 28.7% from 2019) and regulations. Slower than mainland China due to market maturity. |

(Note: Hong Kong motor insurance gross premiums ~HKD 8.1B ($1.04B USD) in 2023 per Insurance Authority data. Estimates derived from APAC total (~$145B in 2024) and market shares: China ~60–70%, Japan ~20%, India ~10%, others smaller. Sources include Allied Market Research for Southeast Asia, Statista for regional breakdowns, and IA for Hong Kong.)

Electric Vehicles Impact on Auto Insurance in APAC

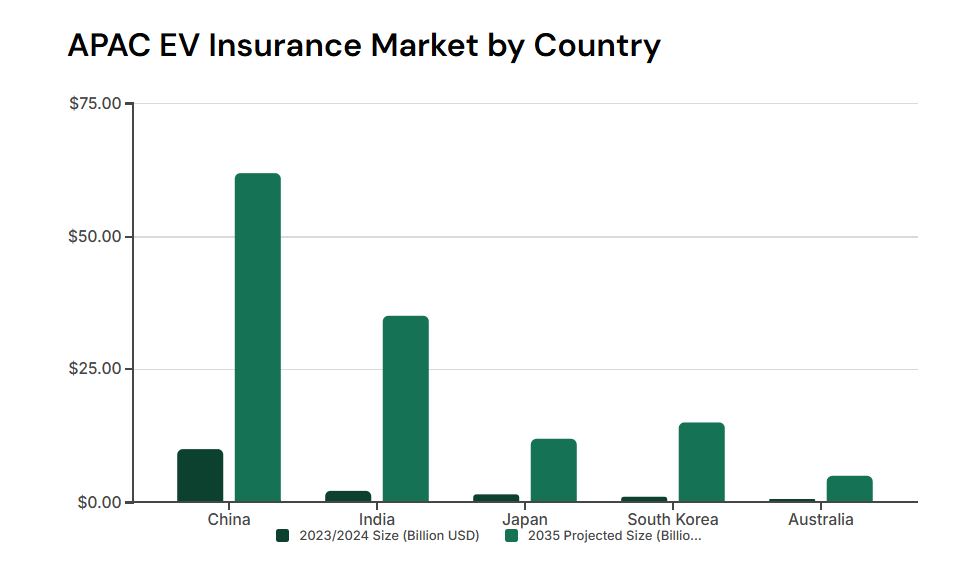

The rise of electric vehicles (EVs) is reshaping the APAC auto insurance market, with higher repair costs (e.g., battery replacements $2,500–$20,000) leading to specialized policies. APAC leads global EV insurance growth, valued at ~$15.42 billion in 2024 and projected to reach $135.21 billion by 2035 (CAGR 21.8%).

China dominates due to massive EV adoption, while India and South Korea focus on incentives and infrastructure. In Hong Kong, EV insurance demand is expected to grow 30% by 2026, driven by government push for EVs and risks like battery damage.

Challenges include higher premiums (10–20% above traditional vehicles) due to repair complexity and battery risks, but opportunities arise from telematics for usage-based insurance.

The table below compares EV insurance situations across APAC countries, including market sizes and projections.

Country/Region | EV Insurance Size (2023/2024, USD Billion) | Projected Size (2035, USD Billion) | CAGR (2025–2035) | Key Situation and Comparison |

China | ~10 (2023, est.) | 62 | ~22% (est.) | Dominant; government policies restrict conventional vehicles, boosting EV insurance demand. Highest growth due to infrastructure. |

India | ~2 (2023, est.) | 35 | ~25% (est.) | Rapid expansion; middle-class growth, sustainable transport focus. Lower penetration but high potential vs. China. |

Japan | ~1.5 (2024, est.) | Not specified | 15–18% (est.) | Mature EV market; focus on hybrid/EV coverage. Slower than China/India due to saturation. |

South Korea | ~1 (2023, est.) | 15 | ~20% (est.) | Tech-driven; incentives for EVs, integrated with auto tech. Balanced growth, behind China but ahead of Japan. |

Australia | ~0.5 (2024, est.) | Not specified | 18% (est.) | EV adoption rising; climate risks increase claims. Comparable to South Korea but smaller scale. |

Thailand | ~0.4 (est.) | Not specified | 21% (est.) | Subsidies drive EV sales; flood risks for batteries. Similar to Malaysia, tourism influence. |

Indonesia | ~0.3 (est.) | Not specified | 22% (est.) | Emerging; government initiatives. Growth potential like India, but infrastructure lags. |

Singapore | ~0.2 (est.) | Not specified | 20% (est.) | Urban EV push; cross-border issues with Malaysia. High digital integration, similar to South Korea. |

Malaysia | ~0.2 (est.) | Not specified | 20% (est.) | EV incentives; integrated with auto sector. Comparable to Indonesia, focus on affordability. |

Hong Kong | ~0.1 (2023, est.) | Not specified | ~25% (est. to 2026: 30%) | Emerging; EV push increases risks/rewards. Growth 30% by 2026, higher than general auto due to urban adoption. Smaller scale vs. China. |

(Note: 2023/2024 estimates based on APAC total ($15.42B in 2024) and shares: China ~65%, India ~20%, others smaller. Projections from Market Research Future; CAGRs estimated from regional trends.)

Comparison of EV and Auto Insurance Markets and Trends

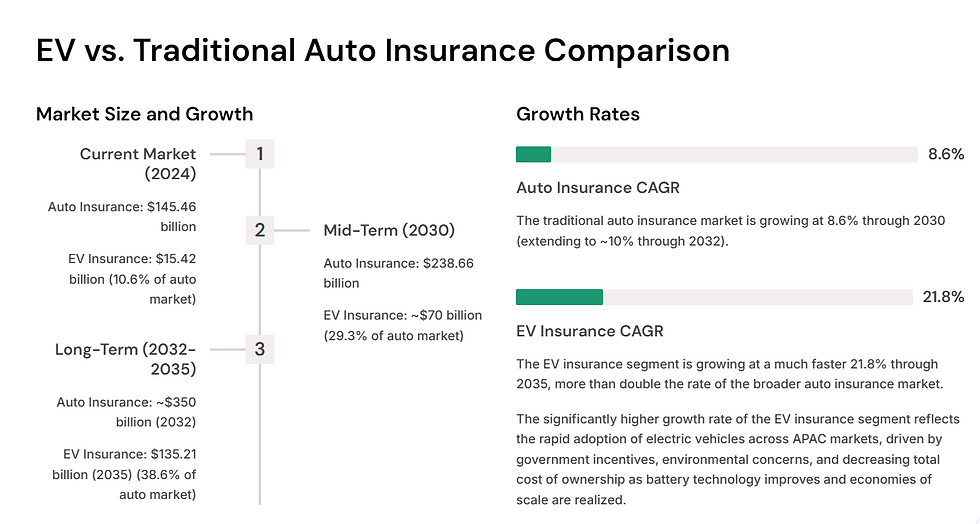

The EV insurance market in APAC is growing significantly faster than the general auto insurance market, with a projected CAGR of 21.8% through 2035 compared to 8.6% for auto insurance through 2030 (extended to ~10% by 2032).

While the auto market focuses on broad coverage for internal combustion engine (ICE) vehicles, driven by rising accidents and digital tools, EV insurance emphasizes specialized risks like battery damage and higher repair costs, leading to premiums 10–30% higher.

Trends show EV adoption accelerating in China and India, integrating telematics for personalized policies, whereas auto insurance trends toward usage-based models amid urbanization. By 2032, EVs could represent 20–30% of APAC's auto insurance premiums, up from ~10% in 2023, as governments push sustainability.

Challenges for EVs include supply chain vulnerabilities and cyber risks, contrasting with auto's focus on accident liability.

The table below highlights key comparisons between the EV and auto insurance markets in APAC.

Aspect | Auto Insurance Market | EV Insurance Market |

Market Size (2024) | $145.46 billion | $15.42 billion |

Projected Size (2032/2035) | ~$350 billion (2032) | $135.21 billion (2035) |

CAGR | 8.6% (to 2030; ~10% to 2032) | 21.8% (to 2035) |

Key Trends | Digitalization, telematics, accident coverage | Battery risks, higher premiums, sustainability integration |

Growth Drivers | Vehicle ownership, road accidents | EV adoption incentives, green policies |

Challenges | Fraud, natural disasters | Repair costs, infrastructure gaps |

Analysis

In APAC, China leads both traditional auto and EV insurance markets due to scale and policy support, with CAGRs often exceeding regional averages.

Hong Kong's market is smaller and more mature, with steady growth in auto (5–7% CAGR) but higher potential in EV (30% by 2026) due to urban EV push.

Emerging markets like India and Indonesia show higher growth potential but face challenges like low penetration and infrastructure gaps.

EV insurance grows faster (CAGR 21.8% vs. auto's 8.6%), driven by adoption rates—China sold millions of EVs in 2023, while India targets 30% EV share by 2030. Insurers are adapting with EV-specific policies, but higher claims (e.g., battery damage) could raise premiums, potentially slowing adoption in cost-sensitive markets like Indonesia.

Conclusion

The APAC auto insurance market is set for robust growth, outpacing global averages, with EVs accelerating transformation. China and India will drive volumes, while mature markets like Japan and Hong Kong focus on innovation. Insurers should invest in digital tools and EV-risk models to capitalize on opportunities amid rising accidents and sustainability trends.

Everbright Actuarial Consulting and Broker Services is your trusted partner in navigating the dynamic APAC auto and EV insurance markets. With expertise in actuarial modeling, risk assessment, and customized brokerage solutions, we help insurers optimize coverage for traditional vehicles and emerging EV risks, ensuring competitive premiums and efficient claims processing. Contact Everbright at info@ebactuary.com to leverage our insights and drive sustainable growth in this fast-evolving sector.

Comments