Constructors All Risks (CAR Insurance) Market in Hong Kong: A Comprehensive Analysis

- EverBright Actuarial

- Oct 5, 2025

- 8 min read

The Constructors All Risks (CAR) insurance market in Hong Kong is a vital component of the broader non-life insurance sector, supporting the region's robust infrastructure and real estate development. CAR policies provide comprehensive coverage for construction projects, protecting against physical damage, third-party liabilities, and various extensions.

The market is characterized by moderate growth, driven by increasing energy, utilities, and infrastructure projects. Major players include international and local insurers like Chubb, AIG, AXA, and Liberty Specialty Markets. Premiums are influenced by project-specific risks, with trends showing sustained growth amid favorable conditions in Asia.

The market size for related property and construction insurance segments is projected to reach around US$903.74 million in 2025 for property insurance, with construction as a key subset. Regulations are governed by the Insurance Authority (IA) under the Insurance Ordinance (Cap. 41), emphasizing authorization, solvency, and risk-based capital requirements. Compared to other countries, Hong Kong's market offers competitive premiums and coverage, though it is smaller than those in the UK and Australia but grows faster than Australia's.

CAR Insurance Product Features

CAR insurance in Hong Kong is designed as an "all risks" policy, covering unforeseen physical loss or damage during construction or erection phases, unless specifically excluded. Key features include:

Material Damage Coverage: Protects against accidental loss or damage to contract works, building materials, and temporary structures.

Third-Party Liability: Covers bodily injury or property damage to third parties arising from construction activities, including non-negligent liabilities.

Extensions and Add-Ons: Common options include coverage for contractors' plant and equipment, delay in start-up (advanced loss of profits), extended maintenance periods, natural catastrophes (e.g., typhoons, earthquakes), consequences of design errors, removal of debris, and primary public liability.

Flexibility: Policies can be tailored for projects ranging from small renovations to large civil engineering works, with options for property damage only or comprehensive packages.

Exclusions: Typically exclude wear and tear, willful negligence, war, nuclear risks, and cyber incidents unless added.

These features make CAR essential for developers, contractors, and principals to mitigate risks in Hong Kong's high-density urban environment.

Constructors All Risks Insurance: Major Players

The CAR market in Hong Kong features a mix of global insurers, local banks, and specialty providers. Authorized insurers must be registered with the IA, with over 100 entities in the non-life sector. Key players offering CAR products include:

Insurer | Key Offerings | Notable Strengths |

Chubb | Builders Risk and Civil Engineering CAR; covers design consequences, natural catastrophes. | Flexible risk management for commercial projects; strong in Asia-Pacific. |

AIG | Contractors' All Risks/Erection All Risks; all-risks cover for property damage and liability. | Global expertise in energy and construction sectors. |

AXA | Contractors' All Risks for interior decoration; accidental damage to materials. | Tailored for SMEs and renovation projects. |

Liberty Specialty Markets | Infrastructure & Construction policies; covers complex technical risks. | High capacity for large-scale projects. |

Allied World | Onshore construction policies; physical loss/damage to works and equipment. | Focus on engineering and building works. |

Zurich | Customized construction plans; third-party liability extensions. | Comprehensive SME-focused offerings. |

Pacific Insurance | Material damage and third-party liability sections. | Local presence with competitive pricing. |

QBE | General construction insurance. | Part of a top global insurer with Hong Kong operations. |

Falcon Insurance | Covers physical and liability losses. | Affordable options for varied project sizes. |

Other notable mentions include Bank of Communications, Shanghai Commercial Bank, and WTW for risk management. The market is competitive, with international firms dominating large projects.

Premium Factors

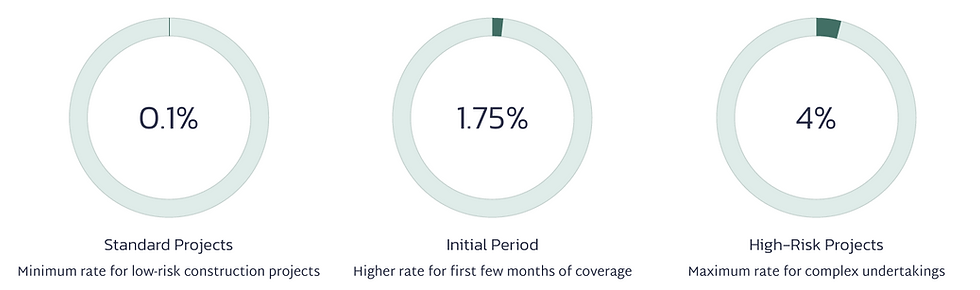

Premiums for Contractors' All Risks (CAR) insurance in Hong Kong are typically calculated as a percentage of the contract value, ranging from 0.1% to 1% for standard projects, though this can vary significantly based on risk assessments.

For more complex or high-risk undertakings, rates may climb to 1%–4% of the total project cost, excluding land value. Insurers employ a risk-based approach, applying a base rate to the sum insured (which includes contract works, materials, plant, and equipment) and adjusting for add-ons, deductibles, and other variables. The calculation process generally involves:

Determining the Sum Insured: This is the foundation of the premium, encompassing the total estimated contract value, including materials, labor, machinery, temporary works, and overheads. For instance, equipment incorporated into the project is factored into this value.

Applying a Base Rate: Insurers use a baseline percentage (e.g., 0.1%–1.75% for the initial period), which is multiplied by the sum insured. Rates are often higher for the first few months (e.g., 1.75% for the initial three months) and lower for extensions (e.g., 0.025% per additional month).

Adding for Extensions and Add-Ons: Optional covers like third-party liability, debris removal (adding 2%–5%), escalation clauses (10%–20% for inflation adjustments), natural catastrophe protection, or surrounding property damage increase the premium by 10%–15% or more, depending on scope.

Adjusting for Deductibles and Discounts: Higher deductibles (common for Section I material damage and varying by peril) reduce premiums, while a strong claims history or robust site safety measures can yield discounts (e.g., no-claim bonuses reducing costs by 10%).

Final Adjustments: Provisional premiums may be paid upfront and adjusted annually based on actual project metrics, such as updated payrolls or turnover for liability components.

Key influencing factors include:

Project-Specific Risks: Higher premiums for large-scale projects (e.g., infrastructure vs. residential), urban density in Hong Kong (increasing collision or third-party risks), and exposure to natural hazards like typhoons or earthquakes, which may add seismic or flood surcharges.

Project Duration and Scope: Longer timelines amplify exposure, leading to prorated increases. For example, a 30-day project with a 3-month defect liability period incurs lower rates than multi-year developments.

Location and Environmental Factors: Projects in high-risk zones (e.g., coastal areas prone to storms) face elevated rates due to Hong Kong's typhoon season.

Insured's Profile: Contractors with poor claims history or inexperienced teams pay more; conversely, proven risk management (e.g., site security, safety protocols) lowers rates.

Market and Economic Conditions: Reinsurance costs, inflation in construction materials/labor, and competitive insurer dynamics influence overall pricing. In Hong Kong, the Insurance Authority levy (typically 0.1%–0.4% of premium) is added to the final cost.

Coverage Breadth: Basic material damage starts lower, but adding third-party liability (e.g., HKD5M–30M limits) or professional indemnity boosts premiums.

Examples from Hong Kong providers illustrate these calculations:

For a HKD300,000 contract (no scaffolding), with HKD10M third-party liability: Premium ≈ HKD1,650 (covering material damage and liability).

For a HKD400,000 contract: Premium ≈ HKD2,000 with HKD20M liability.

For a HKD1,000,000 contract over 30 days (3-month defect period, HKD10M liability): Total premium ≈ HKD4,680 (including IA levy).

Unlike motor insurance (factored by driver age and vehicle type), CAR premiums emphasize holistic project risk profiling, often requiring insurer site surveys or engineering assessments.

Premium Trends

CAR premiums in Hong Kong continue to exhibit moderate upward trends, with annual growth of 5–7% projected through 2025, fueled by surging infrastructure projects in energy, utilities, and transportation.

Favorable market conditions in Asia, including Hong Kong's role as a regional hub, support sustainable rate increases, though global softening in construction insurance tempers this. Natural disaster claims, such as those from typhoons, exert upward pressure—potentially adding 10%–20% to rates in affected years—while intense competition among over 100 authorized insurers helps moderate hikes.

Reinsurance dynamics and rising material costs further influence trends, with premiums for high-risk extensions (e.g., earthquake coverage) seeing sharper rises. In comparison, Hong Kong's rates remain competitive regionally, often 20%–30% lower than in mainland China due to a more mature market and efficient risk management practices.

Market Size

The overall non-life insurance market in Hong Kong is projected at US$13.58 billion in 2025, with property insurance (encompassing CAR) at US$903.74 million.

Construction insurance, as a subset, is estimated to grow moderately, supported by the construction industry's 3.7% growth in 2024 slowing to 0.7% in 2025. Global construction insurance reached USD 24.5 billion in 2023, with Asia-Pacific contributing significantly. Hong Kong's market is smaller but dynamic, with gross premiums for general business at HK$51.4 billion in 2024.

Regulation Requirements

The Insurance Authority (IA) regulates the sector under the Insurance Ordinance (Cap. 41). Key requirements include:

Authorization: Insurers must be authorized by the IA; unauthorized business is prohibited. Minimum paid-up capital (HK$10–20 million depending on class) and solvency margins apply.

Risk-Based Capital (RBC): Implemented to align capital with risks; well-managed firms hold less capital.

Intermediaries: Licensed since 2019; agents limited to four insurers, brokers unrestricted.

Conduct and Compliance: Healthy internal controls, no significant violations, and adherence to codes for brokers/agents.

Other: Annual reporting, fit-and-proper criteria for directors, and restrictions on reinsurance placements.

The regime promotes stability while allowing innovation.

Comparison with Other Countries

Hong Kong's CAR market is competitive and regionally focused, with lower premiums and broader coverage than some peers. Below is a comparative overview:

Aspect | Hong Kong | Singapore | China | UK | Australia |

Market Size (Related Segments, 2025 est.) | Property: US$903M; Construction subset growing at 5–7%. | Similar to HK; total insurance ~US$10B, construction driven by infrastructure. | Much larger; motor/property dominant, construction ~USD 38B globally influenced. | Larger; total non-life ~GBP 80B, construction mature. | Larger than HK; motor/construction ~AUD 22B, steady growth. |

Premium Trends | Moderate increases (5%+); favorable amid Asia growth. | Stable, competitive rates; sustained growth like HK. | Higher premiums (1/3 more than HK); rebounding 5.6% in 2023. | Softening; dramatic falls in auto (16% drop), similar for construction. | Upward pressure (47% rise over 5 years in auto); construction aligns with inflation. |

Key Features/Regulation | All-risks with extensions; strict IA authorization, RBC. | Similar all-risks; MAS regulation, high penetration. | Narrower coverage; CBIRC oversight, compulsory elements differ. | Comprehensive; FCA regulated, focus on claims efficiency. | Broad covers; APRA regulated, climate risks emphasized. |

Strengths/Challenges | Lower costs, urban focus; typhoon risks. | Attractive hub like HK; talent competition. | Massive scale; higher costs, less flexibility vs. HK. | Mature, innovative; higher premiums than HK. | Large market; slower growth (2–3%), natural disaster claims. |

Hong Kong edges out China on affordability and coverage breadth, competes closely with Singapore as Asian hubs, but lags the UK and Australia in size while outperforming in growth rates.

Conclusion

Hong Kong's Construction All Risks (CAR) insurance market is a critical enabler of the region's construction sector, supporting diverse projects from high-rise buildings to infrastructure developments. The market offers comprehensive "all risks" coverage, with flexible extensions like natural catastrophe protection and delay in start-up, tailored to the unique risks of Hong Kong’s urban and typhoon-prone environment.

Major players, including Chubb, AIG, AXA, and local insurers like Pacific Insurance, drive competition, offering robust solutions for projects of varying scales. Premiums, influenced by project-specific risks, contractor profiles, and market dynamics, are moderately rising at 5–7% annually, reflecting Asia's construction growth. The market, part of the US$903.74 million property insurance segment in 2025, is smaller than the UK and Australia but benefits from faster growth and competitive pricing.

The Insurance Authority’s stringent regulations, including authorization and risk-based capital requirements, ensure stability and foster innovation. Compared to Singapore, China, the UK, and Australia, Hong Kong stands out for affordability and coverage breadth, though it faces challenges from natural disaster risks. Continued infrastructure investment and a stable regulatory environment position the market for sustained growth, provided insurers manage emerging risks effectively.

Recommendations

Insurers: Enhance risk assessment models to address natural disaster exposures, particularly typhoons, and offer competitive extensions to capture market share.

Contractors/Developers: Prioritize robust safety and risk management practices to lower premiums and ensure compliance with IA regulations.

Regulators: Maintain the balance between stringent oversight and innovation to support market growth while ensuring financial stability.

Market Entrants: Focus on niche segments like SME renovations or green construction projects to differentiate in a competitive landscape.

Everbright Actuarial Consulting and Broker Services

For businesses navigating the complexities of Hong Kong’s CAR insurance market, Everbright Actuarial Consulting and Broker Services offers unparalleled expertise and tailored solutions. With deep industry knowledge and a client-centric approach, Everbright provides comprehensive risk assessments, competitive premium negotiations, and customized coverage plans to meet the unique needs of construction projects.

Our team of experienced actuaries and brokers collaborates with top insurers to secure cost-effective policies, ensuring optimal protection against material damage, third-party liabilities, and natural disaster risks. By leveraging advanced analytics and market insights, Everbright helps clients minimize costs while maximizing coverage, making them a trusted partner for developers, contractors, and project owners seeking to thrive in Hong Kong’s dynamic construction landscape. Contact Everbright today to elevate your project’s risk management strategy.

Comments