Cyber Insurance Regulations and Landscape in Hong Kong for Financial Institutions

- Sep 3, 2025

- 6 min read

Updated: Oct 9, 2025

As of September 2025, Hong Kong has strengthened its cybersecurity framework through the Protection of Critical Infrastructures (Computer Systems) Ordinance (effective January 1, 2026), which designates banking, securities, and asset management as critical sectors.

Cyber insurance is not mandatory but is increasingly recommended as part of risk management strategies to mitigate financial losses from cyber incidents. Regulatory bodies like the Hong Kong Monetary Authority (HKMA) for banks, the Securities and Futures Commission (SFC) for securities and asset management firms, and the Insurance Authority (IA) for insurers emphasize robust cybersecurity measures, with cyber insurance serving as a key tool for risk transfer. Coverage typically includes incident response, regulatory fines, and business interruption, but excludes willful misconduct.

Costs are rising due to stricter laws, with premiums varying by institution size and risk profile. Providers include global giants like Chubb and local players like DBS. Compared to other jurisdictions, Hong Kong's approach aligns with global trends where insurance is encouraged but not required, though regulations indirectly boost demand.

This report draws on recent regulatory developments and market insights to outline requirements, industry specifics, costs, and international comparisons. Data is organized into tables for clarity. For a basic introduction to cyber insurance, you can refer to: CYBER INSURANCE: COVERAGE, BENEFITS, COST, PROVIDERS, COMPANIES, CLAIMS

Regulations in Hong Kong

Hong Kong's cybersecurity regulations focus on resilience rather than mandating cyber insurance. The new Ordinance targets critical infrastructure operators (CIOs), including financial institutions, requiring organizational setups, preventive measures (e.g., annual risk assessments), and incident reporting (within 12-48 hours). Non-compliance fines range from HK$500,000 to HK$5 million.

HKMA (Banks): Oversees technology risk management, emphasizing third-party cyber risks and resilience. Cyber insurance is recommended for risk transfer but not mandatory.

SFC (Securities and Asset Management): Requires licensed corporations to maintain cybersecurity frameworks, including data protection for client assets. Insurance is part of broader risk mitigation.

IA (Insurers, including those offering cyber products): Guideline GL20 (effective January 1, 2025) mandates cybersecurity strategies, incident response plans, and, at advanced maturity levels, evaluation of cyber insurance needs for the insurer's own risks.

Overall, while not compulsory, the rising threat landscape and regulatory scrutiny (e.g., 61 hacking incidents reported in 2024) are driving adoption to cover gaps in self-mitigation.

Coverage Requirements

Cyber insurance policies in Hong Kong are tailored to financial institutions' high-risk profiles, focusing on data breaches and operational disruptions. Standard coverage includes:

First-party losses: Incident response (e.g., forensics, notification), business interruption, and data restoration.

Third-party liabilities: Legal defense, regulatory penalties (up to insurable limits), and customer claims.

Minimum limits: Often HK$1-10 million for SMEs; HK$50-500 million for large banks/asset managers.

Exclusions: Common for criminal acts, willful negligence, or war/terrorism-related cyber events.

Requirements: Policies must align with regulatory expectations, such as GL20's emphasis on breach notification within 72 hours to the IA.

For financial firms, coverage is customized to include regulatory defense under HKMA/SFC probes.

Industry Specifics on Cyber Insurance

Financial institutions handle sensitive data, making them prime targets. Regulations emphasize sector-specific risks:

Banks: High exposure to ransomware and phishing; must comply with HKMA's e-banking risk guidelines, including third-party vendor assessments. Cyber insurance often covers wire transfer fraud.

Securities Firms: Focus on market integrity; SFC requires protection of trading systems. Insurance addresses insider threats and data leaks affecting client portfolios.

Asset Management Companies: Manage high-value assets; emphasis on client data confidentiality. Policies cover investment disruption losses.

Stablecoin Issuers: Regulated under the Stablecoins Ordinance (effective August 1, 2025), issuers must obtain an HKMA license and adopt a risk-based approach to mitigate risks, including cybersecurity threats.

Key requirements include adopting internationally recognized information security standards (e.g., ISO/IEC 27001), conducting penetration testing, continuous monitoring for cyber threats and data breaches, and independent third-party assessments of critical technology services.

While cyber insurance is not mandated, these stringent cybersecurity obligations indirectly encourage issuers to consider insurance for risk transfer, especially given the high-value digital assets involved and potential for operational disruptions.

Virtual Banks: As digital-only banks licensed by the HKMA, they are subject to the same supervisory requirements as conventional banks, with adaptations for their tech-heavy models. This includes compliance with HKMA's technology risk management guidelines, emphasizing cyber resilience against threats like ransomware and phishing.

The sector faces elevated risks due to its reliance on digital infrastructure, with 2024 seeing a surge in cyber incidents affecting financial services.

Cyber insurance is recommended but not mandatory, aligning with broader financial sector trends where policies cover data breach notifications and legal fees under the Personal Data (Privacy) Ordinance (PDPO), though exclusions apply for fines and willful acts. The HKIA expects appropriate underwriting for cyber risks in this innovative space.

**Common Themes: All sectors require annual cyber risk assessments and drills. The new Ordinance classifies them as CIOs, mandating dedicated security units.

Adoption is growing, with cyber insurance penetration in Hong Kong's financial sector estimated at 60-70% for large firms, driven by global incidents like ransomware attacks.

Costs Compared via Providers

Costs have risen 15-20% in 2025 due to stricter laws and claims frequency, with global cyber premiums projected at $23 billion by 2026. Premiums depend on factors like revenue, data volume, and cybersecurity maturity (e.g., lower for firms with strong controls).

For financial institutions, annual premiums range from HK$50,000 for small asset managers to HK$1-5 million for major banks (coverage limits HK$100-500 million).

The table below compares key providers based on market data, typical premiums for a mid-sized financial firm (e.g., HK$500 million coverage), and strengths:

Provider | Typical Annual Premium (HK$) for Mid-Sized Firm | Key Strengths for Financial Sector | Coverage Focus | Market Share Estimate |

Chubb | 800,000 - 1,500,000 | Global expertise; regulatory fines coverage | Incident response, business interruption | High (global leader) |

AIG | 700,000 - 1,200,000 | Tailored for banks; fraud protection | Third-party liability, data breach | Medium-High |

Zurich | 600,000 - 1,000,000 | Affordable for asset managers; quick claims | Ransomware, extortion | Medium |

Allianz | 750,000 - 1,300,000 | Comprehensive exclusions management | Network security, privacy | Medium |

DBS/Hang Seng | 400,000 - 800,000 | Integrated with banking services; low entry | SME financial risks | Low (niche) |

OneInfinity | 550,000 - 950,000 | Digital asset specialists; innovative partnerships | Crypto/VA-related cyber risks | Emerging |

*Notes: Premiums are estimates for a firm with moderate risk; actual costs vary by underwriting. Sources indicate 15-20% YoY increase due to regulatory changes.

Comparison with Other Countries

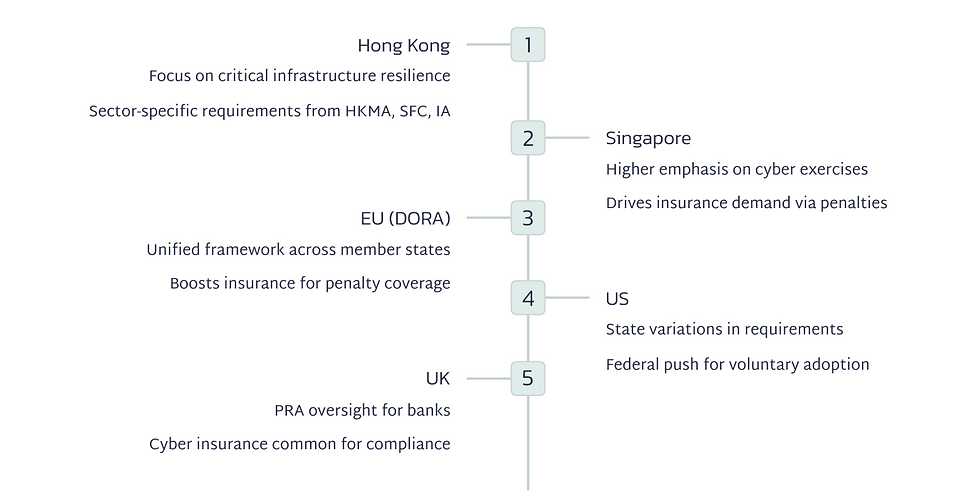

Hong Kong's framework draws from international best practices but is less prescriptive on insurance than some peers. No jurisdiction mandates cyber insurance outright, but regulations indirectly promote it through resilience requirements and penalties. Key comparisons:

Country/Region | Mandatory? | Key Regulations | Coverage Requirements/Industry Specifics | Cost Trends (Relative to HK) | Notes |

Singapore | No | MAS TRM Guidelines; Cybersecurity Act (amended 2025) requires breach notification within 3 days, fines up to SGD 1M. Financial sector must assess third-party risks. | Similar to HK: Incident response, fines; banking focus on digital payments. | Comparable; premiums rising 10-15% due to strict enforcement. | Higher emphasis on exercises; drives insurance demand via penalties. |

US | No (but NYDFSencourages) | NYDFS Cybersecurity Regulation for banks: Requires programs including risk transfer (e.g., insurance). GLBA for data protection. | Broad: Ransomware, liability; banks must cover consumer data breaches. | Higher (20-30% more for similar coverage due to litigation). | State variations; federal push for voluntary adoption in finance. |

UK | No | FCA/PS21/17: Operational resilience rules; cyber hygiene for financial firms. | Focus on third-party risks, business continuity; insurance adapts to GDPR-like fines. | Similar to HK; 15% increase in 2025 from regulatory costs. | PRA oversight for banks; cyber insurance common for compliance. |

EU | No (encouraged under DORA) | DORA (effective Jan 17, 2025): ICT risk management for finance, including third-party oversight. No insurance mandate but risk transfer implied. | Comprehensive: Testing, reporting; banks/insurers must cover operational disruptions. | Slightly higher (due to cross-border compliance). | Unified framework; boosts insurance for penalty coverage. |

Australia | No | APRA CPS 234: Info security for banks; requires resilience, annual audits. Privacy Act amendments increase fines. | Emphasis on supply chain risks; financial sector focuses on consumer data. | Comparable; 10-15% rise from 2025 changes. | APRA enforces third-party audits; insurance seen as key for resilience. |

*Notes: All jurisdictions emphasize notification (e.g., 72 hours in EU/HK) and assessments. Hong Kong's new law aligns closely with Singapore's, but lags EU's unified DORA in scope. Costs globally rising due to claims; HK is moderate compared to litigious US/UK.

Conclusion

Hong Kong's evolving regulations position cyber insurance as a strategic necessity for financial institutions to manage risks amid growing threats. While not mandatory, adoption is accelerating, with costs reflecting heightened scrutiny. Compared internationally, Hong Kong offers a balanced approach, but firms should benchmark against peers like Singapore for best practices. Recommendations: Conduct annual insurance needs assessments and integrate with regulatory compliance plans. For the latest updates, consult HKMA/SFC/IA resources.

For expert guidance in actuarial and consulting services tailored to Hong Kong's insurance landscape, including cyber risk management and regulatory compliance, consider EverBright Actuarial Consulting Limited. Founded in 2014 and headquartered in Hong Kong, EverBright specializes in innovative, AI-driven solutions for actuarial consulting, brokerage, and risk optimization across sectors like life, health, and professional indemnity insurance.

We partner with global insurers to deliver customized strategies that help financial institutions navigate complex challenges, such as IFRS 17 adoption and employees' compensation insurance. Visit www.ebactuary.com and contact us to explore how our expertise can enhance your cyber insurance strategies and ensure robust protection against evolving threats.

Comments