HNWI Insurance Market Prioritize Health Over Wealth: A 2025 Study on Insurance and Longevity Planning

- EverBright Actuarial

- Jul 20

- 5 min read

Updated: Oct 8

The survey by Forbes Insights of 250 HNWIs with net assets of at least HKD 7.8 million (US$1 million) highlights a growing emphasis on health as a cornerstone of financial planning, with 94% of Singaporean HNWIs stating that health is more important than wealth.

However, only 44% feel very or extremely confident about maintaining health post-retirement, and similar concerns persist across the Greater China region. This report expands on the study, comparing HNWI preferences across Singapore, Hong Kong, and mainland China, analyzing preferred insurance products, and exploring the reasons behind these choices to provide a comprehensive view of the evolving HNWI insurance landscape.

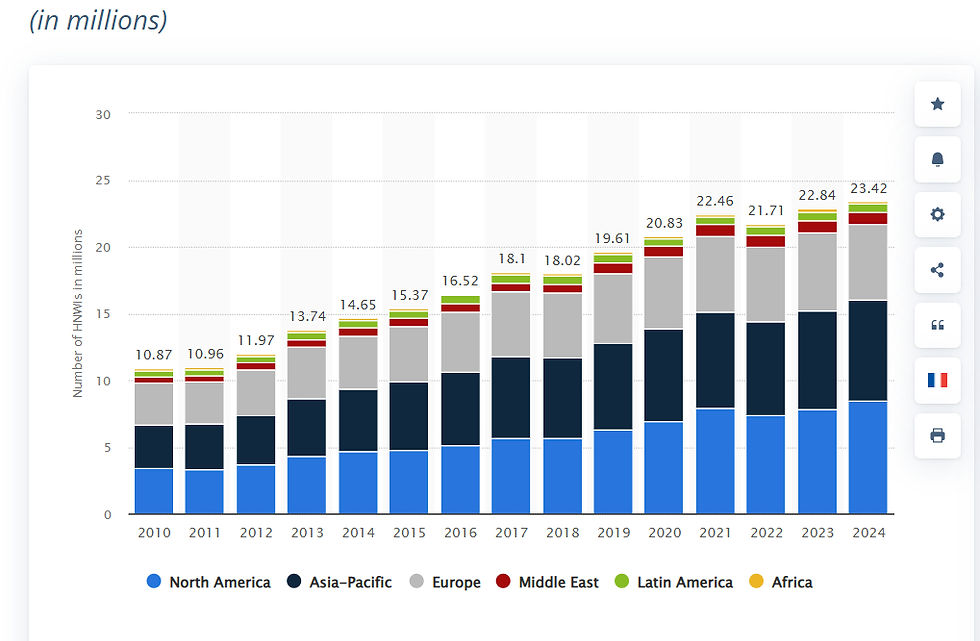

Overview of the HNWI Insurance Market

The global high-net-worth insurance market is projected to grow at a 10% CAGR through 2030, driven by a 30% share of global HNWI wealth in the Asia-Pacific (APAC) region, per Swiss Re’s 2024 report. In 2024, APAC’s HNWI population (net worth of US$1–50 million) grew by 6.9%, with ultra-high-net-worth individuals (UHNWIs, >US$30 million) increasing to 5,300 in Singapore and 1,116 in Hong Kong.

The Greater Bay Area (GBA), encompassing Hong Kong, Macau, and nine mainland Chinese cities, is a key driver, with US$1.9 trillion in GDP and a CNY 300 billion ($42 billion) healthcare market. HNWIs are increasingly integrating insurance into financial planning, with 70% in Greater China allocating insurance to their portfolios, and 30% dedicating 11% or more of assets to insurance products, according to a 2025 Manulife and Deloitte report.

Key market trends include:

Health as a Priority: Across APAC, 96% of HNWIs agree that “nothing is more important than health,” with 65% prioritizing high-end medical protection for retirement.

Wealth Transfer Needs: Approximately 60% of HNWIs in Greater China use insurance for legacy planning, with 67% valuing beneficiary designations to prevent inheritance disputes.

Digital Adoption: 80% mobile penetration in Singapore, Hong Kong, and China drives demand for digital insurance platforms, with 70% of APAC insurers using cloud-based solutions.

Rising Healthcare Costs: Hong Kong HNWIs perceive an 18% increase in healthcare costs in 2024, eroding financial confidence.

Regulatory Support: Hong Kong’s HKRBC regime (effective July 2024) and China’s NFRA 2026 rules encourage tailored insurance products, boosting HNWI adoption.

Challenges include complex healthcare systems (32% of HNWIs report navigation difficulties), high premiums (averaging US$5,000–$20,000 annually), and lack of health knowledge (21% of HNWIs).

Regional Preferences and Product Choices

Singapore

Health Confidence: 94% of HNWIs prioritize health over wealth, but only 44% are very or extremely confident in post-retirement health, and 47% feel confident in financial plans for disability or incapacity.

Preferred Products: Index Universal Life (IUL) products are popular for their market-linked returns and flexibility. Health insurance plans with wellness components are adopted by 49% of HNWIs.

Reasons: Singapore’s 6.9% UHNW growth and high digital adoption (80% online insurance sales) drive demand for flexible, tech-enabled products. HNWIs value stability and wellness integration, with 64% prioritizing financial well-being.

Hong Kong

Health Confidence: 89% view health insurance as essential, but only 47% are very or extremely confident in long-term health, and 44% feel financially prepared for long-term care.

Preferred Products: Life insurance (78% ownership), medical insurance (76%), and savings insurance (60%) dominate, with products offering high returns and wealth transfer features.

Reasons: Hong Kong’s role as a financial hub and 125-year presence of insurers like Manulife drive demand for legacy-focused products. The HKRBC regime encourages robust underwriting, and 60% of HNWIs use insurance for wealth transfer.

Mainland China

Health Confidence: 81% expect to top up retirement benefits, with 76% owning medical insurance and 65% prioritizing high-end medical protection. Only 47% are confident in post-retirement health.

Preferred Products: Whole life and medical insurance are prevalent, with products addressing legacy and healthcare needs. Parametric insurance for critical illnesses is emerging.

Reasons: China’s $2.1 trillion service sector and NFRA mandates boost PLI and health insurance adoption. HNWIs prioritize legacy planning, with 57% using insurance for wealth transfer.

Comparative Analysis of HNWI Insurance Preferences

The table below compares HNWI insurance preferences, product choices, and driving factors across Singapore, Hong Kong, and mainland China, based on 2024–2025 data:

Region | Market Size (2024, US$B) | Health Confidence (Very/Extremely) | Top Insurance Products | Key Drivers | Key Challenges |

Singapore | 1.5 | 44% | Index UL (Manulife Signature IUL, Transamerica Genesis II), Health (AIA Vitality) | High digital adoption (80%), UHNW growth (6.9%) | Complex healthcare systems (32%), health knowledge gaps (21%) |

Hong Kong | 2.0 | 47% | Life (78%), Medical (76%), Savings (60%) (AIA Global Power, Manulife Genesis) | Financial hub, HKRBC, legacy planning (60%) | High premiums, healthcare cost concerns (18% rise) |

Mainland China | 5.0 | 47% | Whole Life, Medical (Manulife Future Assure, Ping An Health), Parametric | Service sector ($2.1T), NFRA mandates | Regulatory complexity, claim delays |

Notes:

Market Size: Estimated based on APAC’s $9.85 billion PLI market share and health insurance contributions, per Cognitive Market Research.

Analysis of Regional Differences

Singapore: HNWIs favor IUL products for their flexibility and market-linked returns, driven by 80% digital penetration and a 6.9% UHNW growth rate. The focus on wellness aligns with 64% prioritizing financial well-being. Challenges include navigating complex healthcare systems (32%) and health knowledge gaps (21%).

Hong Kong: As a financial hub, Hong Kong’s HNWIs prioritize life and medical insurance for legacy planning, with 60% using policies for wealth transfer. The HKRBC regime and 18% perceived healthcare cost rise drive demand, but high premiums challenge affordability.

Mainland China: The largest market ($5 billion) benefits from a vast service sector and NFRA mandates, with 76% owning medical insurance. Parametric products are emerging, but regulatory complexity and claim delays hinder growth.

Reasons for Product Choices

Wealth Preservation and Legacy: 67% of Greater China HNWIs value beneficiary designations to avoid inheritance disputes, favoring life and savings insurance.

Health Security: 65% prioritize high-end medical protection, driven by rising costs and aging populations (46.3 years median age in Hong Kong).

Flexibility: Singapore’s HNWIs prefer IUL for market exposure, while Hong Kong and China favor whole life for stability.

Digital Access: 80% mobile penetration across regions supports digital platforms, enhancing product accessibility.

Outlook and Implications

The Forbes Insights study underscores that HNWIs across Singapore, Hong Kong, and mainland China prioritize health over wealth, with 94–96% valuing health but only 44–47% confident in long-term well-being. The $81.2 billion global PLI market and growing HNWI insurance demand highlight opportunities, but challenges like complex healthcare systems (32%) and high premiums persist.

Consult Everbright Actuarial Consulting for Expert Guidance

To navigate the complexities of HNWI insurance or tailor solutions for health and legacy planning, contact Everbright Actuarial Consulting at info@ebactuary.com . Our team offers customized risk assessments, product evaluations, and strategic insights to align with your financial and health goals in the dynamic APAC market. Reach out for consultations or educational resources to secure your future.

Comments