Home Insurance in Hong Kong: Your Complete Protection Guide

- Jan 15

- 9 min read

Updated: Jan 28

In Hong Kong's high-density urban environment, home accidents such as flooding, typhoon damage, or theft occur from time to time. especially with intensifying climate change, protecting home safety has become increasingly important. Home insurance not only mitigates financial loss but also provides peace of mind.

This article will demystify the basics of home insurance, including the differences between Fire Insurance and Home Insurance, coverage scope, premium calculations, product trends, the claims process, and how to choose the right plan. It also provides practical explanations for claims in common scenarios such as water leakage from the floor above, burst pipes, and windows broken by typhoons.

Categories of Home Insurance Products

In recent years, the home insurance market has diversified, subdividing products based on target users, depth of coverage, and specific features:

Tenant-Specific Plans

Targeted at tenants, covering personal belongings and third-party liability, excluding building structure.

Features: Low premiums, simple application, often includes temporary accommodation expenses.

Suitable for: Young tenants, small units.

Landlord/Homeowner Standard Plans

Covers home contents, third-party liability, and sometimes loss of rent (if the rental unit is damaged).

Features: Can add building structure extensions, suitable for owner-occupiers.

Comprehensive Family Plans

The most common all-inclusive type, including contents, liability, worldwide personal belongings, temporary accommodation, and emergency home assistance (24-hour plumbing/electrical repair).

Features: High coverage limits, suitable for families with children or valuable items.

High-End/Valuable Items Plans

Targeted at high-value homes (e.g., fine art, jewelry, antiques), offering "Replacement Value" (compensation without depreciation) and high single-item limits.

Features: Requires declaration of valuables list, can add specific coverage for art/wine cellars.

Digital/Smart Home Plans

Emerging trend, covering smart devices (e.g., smart locks, surveillance cameras) and cyber attack losses.

Features: AI risk assessment discounts, home IoT data integration.

Coverage Scope of Home Insurance

Home insurance is a comprehensive plan offering extensive protection, commonly including:

Home Contents Coverage: Loss of furniture, appliances, clothing, and jewelry due to accidents like fire, flooding, theft, or typhoons. Maximum compensation can reach HK$1,000,000–1,500,000, depending on the plan.

Third-Party Liability Coverage: If an accident causes bodily injury or property damage to a third party (e.g., water leakage damaging a neighbor's unit), compensation can reach HK$8,000,000–10,000,000.

Additional Benefits: Temporary accommodation expenses (hotel costs after flooding), loss of rent (for landlords if the rental unit is damaged), personal accident (accidental death in the home starting from HK$250,000), and emergency repair services (e.g., 24-hour plumber).

Optional Extensions: Worldwide personal belongings (e.g., laptop lost while out), domestic helper's belongings, pet medical expenses, etc.

Exclusions include natural wear and tear, war, or willful damage. Before insuring, assess the value of belongings to avoid under-insurance. The following table lists common coverage items and typical limits for mainstream products (subject to actual policy, customizable):

Coverage Category | Detailed Benefits | Typical Limit (HK$) | Common Extension Options |

Home Contents Coverage | Damage to furniture, appliances, clothing due to fire, flood, typhoon, theft, burst pipes | 500,000–1,500,000 | High-value single items (jewelry/watches) 50,000–200,000 |

Third-Party Liability Coverage | Accidental bodily injury or property damage to third parties (e.g., leakage damaging unit below, falling glass injuring people) | 8,000,000–20,000,000 | Legal fees extra 100,000–300,000 |

Temporary Accommodation/Extra Expenses | Hotel accommodation, meals, transport expenses after flood or fire | 1,000–2,000 daily, max 90 days | Loss of rent (Landlord's rental unit) |

Worldwide Personal Belongings | Loss or damage of laptops, phones, glasses outside | 10,000–50,000 | Credit card theft protection |

Emergency Home Assistance | 24-hour plumber, electrician, locksmith on-site | 2,000–5,000 per visit, unlimited annual limit | Pet medical/Domestic helper belongings |

Smart Home Extension | Device damage due to cyber attacks, smart lock malfunction | 10,000–30,000 | IoT data breach liability |

General Exclusions: Normal wear and tear, lack of maintenance, war, willful acts. Some plans exclude flooding (require purchasing rainstorm extension).

How to Choose the Right Home Insurance

Assess Needs: Landlords focus on liability + structure; tenants focus on contents.

Compare Products: Compare coverage, premiums, and deductibles. Check exclusions (e.g., wear and tear).

Company Reputation: Understand the company's service and claims processing speed.

Professional Consultation: Contact professional brokers to customize solutions and get the best market quotes.

Attention to Detail: Sufficient sum insured (1.5x total value of contents), flexible terms (1 year/short-term).

Difference Between Fire Insurance and Home Insurance: Which Do Landlords and Tenants Need?

Many people confuse Fire Insurance (also known as Building Structure Insurance) with Home Insurance; the targets and scope of coverage are distinct. Fire Insurance mainly protects the building's "hardware structure," such as walls, ceilings, floors, pipes, and fixed installations like windows/doors, covering damages from accidents like fire, lightning, flooding, typhoons, and landslides.

Home Insurance focuses on "software contents," including home belongings (furniture, appliances), third-party liability, and additional living expenses.

Landlords: Usually need to purchase Fire Insurance, especially for mortgaged properties (bank mandatory), to cover building reconstruction costs. It is also recommended to add Home Insurance to protect indoor contents and liability risks (e.g., leakage affecting neighbors). If the housing estate has a Master Policy for fire insurance, owners may be exempt from double purchasing but still need Home Insurance to fill the gap.

Tenants: Do not need Fire Insurance (landlord's responsibility) but should buy Home Insurance to protect personal belongings (e.g., clothes, laptops) and third-party liability (e.g., accidental damage to the unit).

The following table compares the two:

Comparison Item | Fire Insurance (Building Structure) | Home Insurance |

Target of Coverage | Building structure (walls, floors, pipes) | Home contents (furniture, appliances), Third-Party Liability |

Common Risks | Fire, Typhoon, Landslide | Flood, Theft, Burst Pipes, Personal Accident |

Mandatory? | Mortgage owners usually required | Not mandatory, but recommended |

Suitable For | Landlords | Landlords and Tenants |

Premium Level | Lower (0.03-0.04% of reinstatement value) | Depends on coverage scope (Annual fee from HK$400) |

The two cannot replace each other; landlords are advised to have both.

Comparison of Home Insurance Products in the Hong Kong Market

The Hong Kong home insurance market is fiercely competitive, with mainstream products coming from traditional insurance companies and digital insurance platforms. The following table compares five popular plans (based on a standard Comprehensive Family Plan, Contents Coverage HK$1,000,000, Third-Party Liability HK$10,000,000; actual premiums vary by unit size, building age, and personal factors):

Company/Product | Annual Premium Range (HK$) | Contents Coverage (Max) | Third-Party Liability (Max) | Key Features | Extension Options | Claims Speed/Customer Rating (2026) |

Zurich Home Insurance | 900–1,800 | 1,500,000 | 20,000,000 | 24-hour emergency assistance, Worldwide personal belongings, "New for Old" option | Smart home extension, Pet medical | Fast (7–10 days) / 9.2/10 |

AXA SmartHome Plus | 800–1,600 | 1,200,000 | 15,000,000 | AI risk assessment discount, High temp accommodation, Loss of rent | Cyber attack protection, Green home discount | Medium (10–14 days) / 9.0/10 |

HSBC Home Contents Insurance | 700–1,500 | 1,000,000 | 10,000,000 | Bank customer discount, Emergency repair service, High single item limits | Worldwide belongings, Credit card theft | Medium (10–14 days) / 8.8/10 |

OneDegree Home Insurance | 600–1,200 | 1,000,000 | 12,000,000 | Fully digital application/App claims, Young family offers, Smart devices | IoT sensor integration discount, Short-term tenant plans | Fastest (5–10 days) / 9.4/10 |

Dah Sing Home Protector | 750–1,400 | 1,200,000 | 15,000,000 | Strong loss of rent coverage, Family accident extension, Domestic helper belongings | GBA cross-border extension, Old building reinforcement discount | Medium (10–14 days) / 8.7/10 |

Comparison Points:

Premium Competition: Online application products are the most affordable, while high-end coverage is the most comprehensive.

Feature Differences: Online platforms emphasize convenience and discounts; traditional companies have more mature emergency assistance.

Target Audience: Tenants can consider online platforms; landlords renting out units should choose traditional insurers; tech-savvy families should select products compatible with smart home tech.

Overall Trend: In 2026, claims speed has become a key indicator, with digital companies leading.

Premium Calculation, Ranges, and Trends

Key Factors for Premium Calculation:

Unit Size: (HK$1–3 per sq. ft.).

Building Age & Location: (Old buildings/low-lying areas add 10–30%).

Coverage Amount & Deductible: (High deductible reduces premium by 15–30%).

Risk Assessment: (AI data, installing anti-theft/flood sensors reduces premium by 5–20%).

User Type: (Tenants are cheapest, landlords renting out are highest).

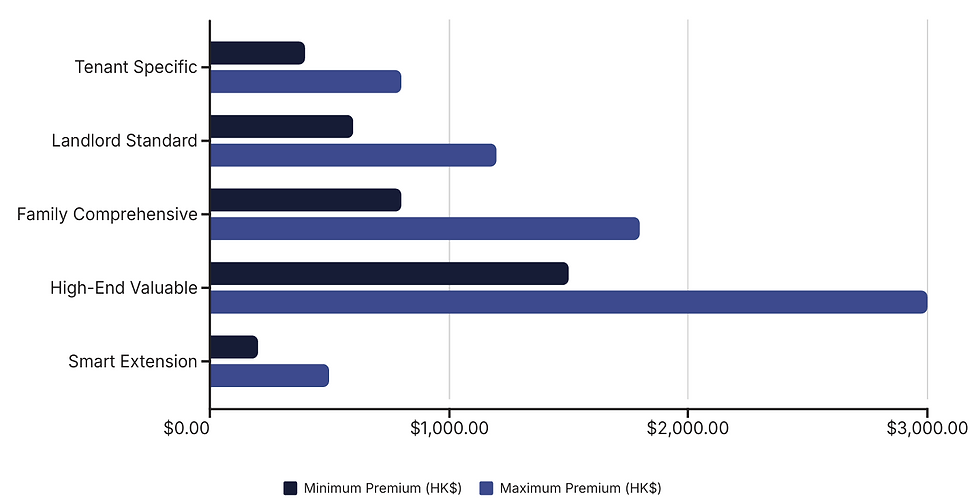

Home Insurance Premium Range Table (Estimated Annual Fee, Case Dependent):

Product Category | Annual Premium Range (HK$) | Typical Coverage (Contents/Liability) | Suitable For |

Tenant Specific | 400–800 | 300,000–800,000 / 8M | Tenants, Small units |

Landlord Standard | 600–1,200 | 800,000–1,200,000 / 10M | Owner-occupiers |

Family Comprehensive | 800–1,800 | 1,000,000–1,500,000 / 15M | Families with kids/valuables |

High-End/Valuable | 1,500–3,000+ | 1,500,000+ / 20M | High-net-worth individuals |

Digital/Smart Extension | +200–500 (Add-on) | Extra smart devices 10,000–50,000 | Young tech families |

Premium Trends: In 2026, overall premiums will drop slightly by 3–8% (due to intensified competition and precise AI pricing); digital plans are growing fastest; Green Homes (energy-saving devices) receive discounts; Cross-border GBA products are emerging (covering second homes in Shenzhen).

Claims for Home Insurance

Claims processing is standardized, with a focus on evidence:

Report Accident: Notify the company within 24-48 hours with details.

Collect Evidence: Photos, receipts, Police/Civil Aviation Department reports (if applicable).

Company Investigation: Assess liability (AI accelerated analysis).

Approval & Payout: Payment made after deducting deductible/depreciation; direct payment to victims for third-party claims.

Average success rate reaches 90%; retaining records can accelerate the process.

Claims Procedure:

Immediate Recording: Take photos/videos of onsite damage, keep documents (e.g., purchase receipts).

Notify Insurance Company: Report within 24-48 hours after the accident (via App or Hotline).

Submit Evidence: Damage list, police report (if third party involved), repair quotations.

Investigation & Payout: Company review (surveyors may be sent); simple cases complete in 7-14 days, complex cases in 1-3 months.

Claims success rates are higher when the Observatory issues Typhoon Signal No. 8 or above.

Water Leakage from Above, Burst Pipes: How Home Insurance Covers Property Loss and Third-Party Liability?

Water leakage and burst pipes are common home issues in Hong Kong, divided into "External Flooding" (rainstorm backflow) and "Internal Leakage" (burst pipes). Home insurance usually covers property loss caused by accidents (e.g., burst pipes) leading to damages like soaked floors or appliances; compensation depends on the extent of damage. If leakage from the unit above affects your own unit, insurance compensates for home contents loss; conversely, if your burst pipe soaks the unit below, Third-Party Liability coverage handles neighbors' claims, including repair costs and legal fees (up to HK$100,000).

Note: If leakage is due to wear and tear or lack of maintenance, it is an exclusion. Installing flood sensors is recommended; some plans offer prevention discounts.

Typhoon Window Breakage: Claims Procedure for Home Property Damage Caused by Typhoons

Typhoons are frequent in Hong Kong, and broken windows are common. Home insurance covers window damage and subsequent property loss (e.g., furniture soaked by rain) caused by typhoons or rainstorms. Even if aluminum windows have been replaced, as long as it was not due to human negligence, claims can be made (based on actual value less depreciation). If falling glass injures someone, Third-Party Liability applies.

Other Common Home Insurance Claims Examples

Below are several common home insurance claims scenarios in Hong Kong (not specific cases, based on industry case studies and insurer reports). These examples demonstrate how insurance actually functions and remind of the importance of retaining evidence. The claims success rate typically reaches over 90%; the key lies in the incident being accidental rather than due to lack of maintenance.

Case 1 (Burglary/Theft):

While the owner was away on vacation, the unit was burgled, resulting in the loss of a laptop, jewelry, and cash (Total value HK$80,000). The user had a comprehensive plan and submitted police report records, purchase invoices, and photographic evidence. The insurance company investigation confirmed the lock was picked (not human negligence), fully compensating the content loss (within single item limits for jewelry) and covering lock replacement costs. The process took about 2–3 weeks.

Reminder: Valuable items need single item declaration; installing anti-theft systems may earn premium discounts.

Case 2 (Minor Kitchen Fire):

An induction cooker short-circuited while a tenant was cooking, causing a small fire that burnt kitchen cabinets and some appliances (Damage cost HK$40,000). Although not a major fire, it fell under home contents coverage. Fire Services Department report and site photos were submitted. The insurance company paid after deducting minor depreciation. Simultaneously, if the fire affected the floor below, Third-Party Liability would handle the neighbor's loss. Claims took about 10–14 days.

Reminder: If appliance aging is not regularly checked, claims might be partially rejected.

Case 3 (Rainstorm External Flooding):

During Typhoon Signal No. 8, blocked roof drainage caused backflow flooding into a lower-floor unit, soaking the floor, sofa, and TV (Damage cost HK$60,000). The user submitted Observatory signal records and flood photos. The insurance company confirmed it was external flooding (not internal leakage/aging), fully compensating and providing temporary accommodation expenses (Hotel for 3 nights). The process was smooth, taking about 2 weeks.

Reminder: Users in low-lying areas should add rainstorm extension coverage.

Case 4 (Visitor Slip and Injury – Third-Party Liability):

A friend visited and slipped on a wet floor, suffering a sprain requiring medical attention (Cost HK$25,000). The user's home insurance Third-Party Liability coverage handled medical fees and legal costs directly, avoiding huge personal liability. Medical reports and witness statements were submitted. The insurance company fully compensated the third party. Claims were fast, about 7–10 days.

Reminder: Liability coverage limit is suggested to be at least HK$10,000,000.

Case 5 (Accidental Damage to Valuables by Child):

A child playing at home accidentally broke a valuable vase and TV screen (Total value HK$30,000). Classified as accidental damage, contents coverage applied. Photos and proof of purchase were submitted, and compensation was paid after depreciation. High-end plans offer "Replacement Value" (New for Old) options for higher payouts.

Reminder: Intentional damage or regular destruction by pets may not be covered.

These scenarios show that home insurance not only compensates for property but also covers liability and extra expenses. Timely reporting (within 24–48 hours) and complete evidence are keys to success. Violation of exclusions (e.g., lack of maintenance) may lead to rejection.

Conclusion

Home insurance is a necessity for life in Hong Kong, preventing accidental losses. Whether for landlords or tenants, choosing the right plan brings peace of mind. Regularly review your policy to ensure it meets your latest needs.

If you are interested in home insurance, EverBright Actuarial Consulting Limited provides professional actuarial and insurance brokerage services. We focus on risk management and customized insurance solutions, partnering with global partners and local insurance institutions to optimize your home protection. Welcome to contact us for a free consultation and insurance solutions!

Comments