Comprehensive Guide to Management Liability Insurance 2025

- EverBright Actuarial

- Sep 16, 2025

- 7 min read

Management Liability Insurance (MLI) is a critical safeguard for businesses, protecting directors, officers, and the organization from financial losses due to managerial decisions and employment practices.

This updated report expands on the original overview with new sections on emerging risks, recent claim examples, and global market trends as of September 2025. It incorporates the latest data from industry sources, reflecting market stability, softening premiums, and evolving threats like AI, cyber risks, and ESG factors. Special focus remains on the Hong Kong market, with enhanced comparisons to the US, UK, Singapore, and Australia.

Definition of Management Liability Insurance

Management Liability Insurance is a specialized policy that covers risks arising from the management activities and decisions of directors, officers, managers, and the organization itself. It addresses claims related to alleged wrongful acts in areas such as fiduciary duties, employment practices, and regulatory compliance.

Unlike general liability insurance, which focuses on third-party bodily injury or property damage, MLI targets internal governance and leadership exposures.

It typically bundles coverages like Directors and Officers (D&O) liability, Employment Practices Liability (EPL), and Fiduciary Liability. In 2025, MLI has seen increased relevance due to heightened litigation and technological risks, with global markets emphasizing integrated protections against cyber and ESG-related claims.

Key Features of MLI Policies

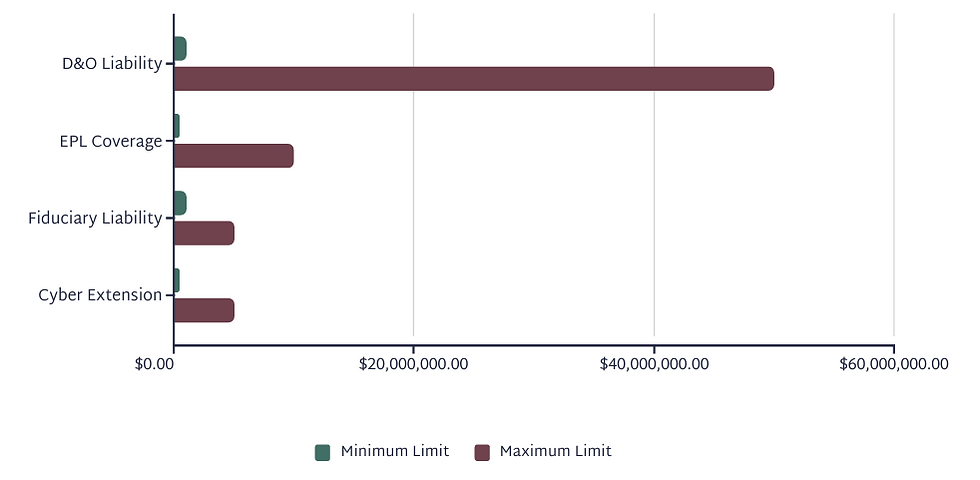

MLI policies offer tailored protection against a range of leadership-related risks. The following table summarizes core features, updated with 2025 enhancements like optional AI and ESG endorsements:

Feature | Description | Typical Coverage Limits |

Directors & Officers (D&O) Liability | Protects individuals and entities from claims of mismanagement, breach of fiduciary duty, or misrepresentation. Includes Side A (personal coverage), Side B (indemnification), and Side C (entity coverage). Now often includes AI decision-making defenses. | $1M–$50M, depending on company size |

Employment Practices Liability (EPL) | Covers employee claims for discrimination, harassment, wrongful termination, or retaliation. Expanded in 2025 to address remote work and DEI-related disputes. | $500K–$10M |

Fiduciary Liability | Safeguards against mismanagement of employee benefit plans (e.g., pensions under ERISA in the US). Increasingly covers ESG fund mismanagement. | $1M–$5M |

Regulatory Investigation Defense | Pays for legal costs from government probes (e.g., SEC or equivalent). | Up to policy limit |

Crisis Management | Optional add-on for reputational harm response, now including cyber incident coordination. | Varies ($100K–$1M) |

Cyber and Social Engineering Extension | Emerging add-on for fraud or data breaches tied to management decisions. | $500K–$5M (optional) |

These features ensure comprehensive defense costs, settlements, and judgments, often on a claims-made basis.

Claims: Types and Process

Claims under MLI are common in litigious environments, with the most frequent involving shareholder disputes or employee grievances. In 2024–2025, global claims rose due to economic volatility, regulatory scrutiny, and emerging issues like AI-driven decisions.

As of mid-2025, claims frequency has stabilized but severity has increased in areas like EPL due to post-pandemic workplace changes.

Common Claim Types

Claim Type | Examples | Frequency (Global Estimate, 2025) |

Shareholder Lawsuits | Alleged fraud or misleading financials. | 40% of D&O claims |

Employment-Related | Discrimination, harassment, or retaliation suits. | 35% of EPL claims |

Fiduciary Breaches | Mismanagement of 401(k) or pension funds. | 15% |

Regulatory | Non-compliance investigations (e.g., data privacy). | 10% |

Claims Process

Notification: Report potential claims immediately to the insurer (within policy-specified timeframe, often 30–60 days).

Investigation: Insurer assesses coverage applicability.

Defense: Appoint counsel; insurer funds legal fees (subject to limits).

Settlement/Judgment: Pay approved amounts; average settlement ~$500K–$2M.

Resolution: Post-claim review to adjust future premiums.

Timely reporting is crucial, as policies are claims-made, covering only incidents reported during the policy period.

Management Liability Insurance Premiums

Premiums for MLI vary significantly, averaging $5,000–$50,000 annually for small businesses and up to $1M+ for large corporations in 2025.

Rates have softened globally, with reductions of 5–20% in many markets due to increased capacity and competition. In Q2 2025, overall stability persists, though emerging risks may lead to slight increases in high-exposure sectors.

Premium Factors and Calculation

Premiums are calculated using a risk-based model, starting with base rates adjusted by exposure metrics. Key factors include, with 2025 updates reflecting AI and cyber influences:

Factor | Impact on Premium | Example Adjustment |

Company Size/Revenue | Larger revenue increases exposure; base rate scales with payroll/revenue. | +20–50% for >$100M revenue |

Industry Risk | High-risk sectors (e.g., finance, tech) face higher rates; AI/tech adds 10–15%. | +15–30% for fintech |

Claims History | Prior claims raise rates; clean record discounts. | +10–100% surcharge |

Coverage Limits/Deductible | Higher limits or lower deductibles increase costs. | $10K deductible saves 10–20% |

Location/Geography | Regulated markets (e.g., US) cost more than Asia-Pacific. | +5–15% in litigious areas |

Financial Stability | Strong balance sheets qualify for discounts. | -5–10% for A-rated firms |

Emerging Risk Exposure | ESG, cyber, or AI usage can add surcharges. | +5–10% for high AI reliance |

Premium Calculation Formula

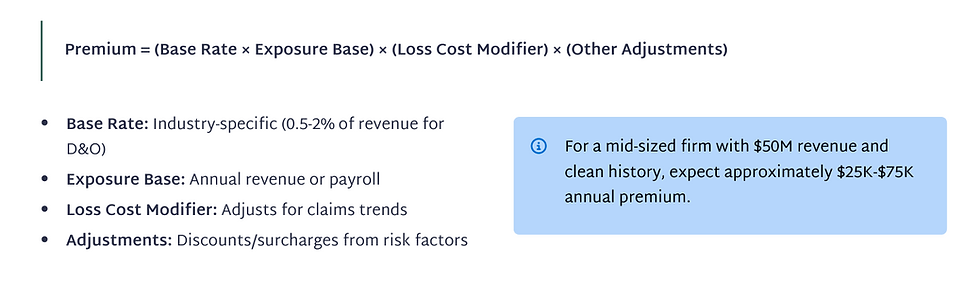

Premium = (Base Rate × Exposure Base) × (Loss Cost Modifier) × (Other Adjustments)

Base Rate: Industry-specific (e.g., 0.5–2% of revenue for D&O).

Exposure Base: Often annual revenue or payroll (e.g., 1% of $10M revenue = $100K base).

Loss Cost Modifier: Adjusts for claims trends (e.g., 1.1 for rising litigation).

Adjustments: Discounts/surcharges from factors above.

For a mid-sized firm ($50M revenue, clean history), expect ~$25K–$75K annual premium. Tools like actuarial software refine this.

Hong Kong Market Overview

Hong Kong's insurance sector is robust, with total gross premiums reaching HK$220.3 billion ($28.6 billion) in Q1 2025 alone, up from prior years.

General insurance, including MLI subsets like D&O, is projected to grow at 5.1% CAGR to HK$85.4 billion by 2029. As of September 2025, MLI demand is driven by fintech growth, regulatory scrutiny from HKMA, and cross-border exposures. Rates declined 13% in Q1 2025, with further softening to -3% across Asia, making it buyer-friendly amid geopolitical stability.

Key Hong Kong Market Stats

Metric | Value (2025 Projection/Actual) | Notes |

General Liability Premiums | US$6.76 billion | Includes MLI components |

Total Insurance Premiums | US$85.07 billion (overall market) | Life dominates; non-life at 20% |

MLI Penetration | ~15–20% of mid/large firms | High in finance sector |

Average D&O Premium | HK$50K–$500K for SMEs | Softening rates (-13% YoY) |

Market Growth Rate | 5.1% CAGR (2025–2029) | Driven by economic recovery |

Comparison to Other Countries

Hong Kong's MLI market is mature but smaller than the US/UK, with lower premiums due to less litigation intensity.

Singapore mirrors HK closely, while the US sees higher costs from class actions. Australia has experienced positive shifts in 2025 with more opportunities for well-managed risks. The table below compares key aspects as of September 2025:

Aspect | Hong Kong | US | UK | Singapore | Australia |

Avg. Annual Premium (Mid-Size Firm) | HK$100K–$300K (~US$13K–$38K); -13% YoY decline | US$50K–$200K; stable, +2% YoY | £40K–£150K (~US$52K–$195K); flat | S$80K–$250K (~US$60K–$185K); -18% YoY | AUD$75K–$250K (~US$50K–$165K); softening -5–10% |

Coverage Scope | Strong D&O/EPL; regulatory focus (HKMA). Limited cyber integration. | Broad, includes entity coverage; high securities litigation. | Comprehensive fiduciary; EU-aligned privacy. | Similar to HK; ASEAN regulatory emphasis. | Emphasis on D&O for SMEs; growing ESG add-ons. |

Market Size (Non-Life Premiums) | US$10.9B (2029 proj.) | US$800B+ (overall) | £250B+ | US$5B+ | AUD$50B+ (overall non-life) |

Key Drivers/Risks | Fintech growth, China ties; lower litigation. | Class actions, SEC probes; high claims frequency. | Brexit residuals, GDPR; moderate growth. | Regional trade, MAS regs; competitive rates. | Economic volatility, workforce changes; positive market shift. |

Rate Change (Q1-Q3 2025) | -13% to -3% | -5% | -7% | -18% | -5–10% |

Emerging Risks Management Liability Insurance Face

In 2025, MLI faces new challenges from technological, environmental, and economic shifts. Key emerging risks include AI integration in decision-making, cyber threats, and ESG compliance, which could drive up claims severity.

Insurers are adapting with specialized endorsements, but underwriting scrutiny has increased for high-exposure firms.

Emerging Risk | Description | Potential Impact on MLI |

AI and Technology | Bias in AI-driven hiring or financial decisions leading to discrimination or fiduciary claims. | Increased EPL/D&O claims; +10–15% premium adjustments. |

Cyber Threats | Ransomware or data breaches attributed to management oversight. | Overlap with cyber policies; rising fiduciary exposures. |

ESG Factors | Failure to meet sustainability standards, leading to shareholder or regulatory suits. | Growing in D&O; environmental litigation up 20%. |

Economic Volatility | Bankruptcy filings and layoffs triggering retaliation claims. | Higher EPL frequency; economic-driven loss ratios. |

Supply Chain Disruptions | Global events causing mismanagement allegations. | Entity coverage strain; emerging in Asia-Pacific markets. |

Recent Claim Examples

Recent claims highlight the practical applications of MLI. Based on 2025 reports, examples include post-layoff discrimination suits and fiduciary breaches, with average defense costs exceeding $200K. These underscore the need for robust coverage.

Claim Example | Details | Coverage Triggered & Outcome |

Age Discrimination Post-Layoff | Insurance brokerage laid off employees; one filed EEOC charge for age bias. | EPL; EEOC ruled in favor, no court action; defense costs ~$100K. |

Wage and Hour Violation | Restaurant franchise sued for unpaid overtime by service workers. | EPL; $100K defense, settled undisclosed. |

Breach of Fiduciary Duty | Officer hired personal connections as vendors, leading to $2M investor suit. | D&O; Ongoing, defense ~$200K to date. |

Disability Retaliation | Post-pandemic workplace changes led to complex retaliation claims. | EPL; Emphasizes need for training; average settlements rising. |

ESG Mismanagement | Failure in sustainable fund handling prompted shareholder action. | Fiduciary; Increasing in 2025 with regulatory focus. |

MLI Global Market Trends

As of September 2025, the global MLI market shows stability with ample capacity, but emerging risks like AI and cyber are causing underwriting concerns. Premiums have softened 5–20% year-over-year, driven by competition, though claims trends may lead to small increases.

Private organizations face economic, workforce, cyber, and AI-driven risks, with D&O global market valued at $8.51 billion in 2025, growing at 14.1% CAGR through 2033. Asia-Pacific, including Hong Kong, benefits from lower litigation but monitors China ties and fintech exposures.

Trend | Description | 2025 Impact |

Premium Softening | Increased insurer capacity leading to competitive pricing. | Reductions of 5–20% globally; buyer-friendly. |

Litigation Increase | Rise in securities class actions and employment disputes. | Higher claims frequency in US/UK. |

AI/Cyber Integration | Policies adapting to tech risks; more endorsements available. | Potential rate hikes in tech sectors. |

ESG Focus | Regulatory push for sustainability disclosures. | New claim drivers; growth in fiduciary lines. |

Market Growth | Overall non-life premiums up 7.4%; Asia at 5.1% CAGR. | Expansion in emerging markets like Singapore/HK. |

Risk Mitigation Strategies

To reduce MLI exposures, companies should:

Implement AI governance policies and regular audits.

Enhance cyber hygiene and integrate with dedicated cyber insurance.

Adopt ESG frameworks with board oversight.

Conduct employee training on DEI and compliance.

Review policies annually with brokers for gaps.

These proactive steps can lower premiums and claim likelihood.

Conclusion

Management Liability Insurance remains essential for mitigating governance risks in an uncertain 2025 landscape. With softening premiums, emerging threats like AI and ESG, and stable markets, businesses—especially in Hong Kong—should prioritize tailored coverage.

Companies are encouraged to conduct annual risk assessments, leverage new endorsements, and consult brokers like Everbright for optimized protection.

Everbright Actuarial Consulting and Brokerage

For businesses navigating the complexities of Management Liability Insurance, Everbright Actuarial Consulting and Brokerage offers unparalleled expertise and tailored solutions.

With a deep understanding of Hong Kong’s dynamic market and global trends, Everbright provides comprehensive risk assessments, customized policy recommendations, and competitive premium negotiations.

Our team of seasoned actuaries and brokers ensures clients receive robust coverage for emerging risks like AI, cyber threats, and ESG compliance, all while optimizing costs.

Partner with Everbright to secure your organization’s future with confidence, leveraging their industry insights and strong insurer relationships. Contact them at www.everbrightconsulting.com for a consultation.

Comments