Mastering Group Medical Insurance Claims in Hong Kong’s Costly Healthcare Landscape

- Hongji Medical Group

- Jul 20, 2025

- 4 min read

Updated: Jul 21, 2025

Hong Kong’s private healthcare system, among the world’s most expensive, poses significant challenges for corporate group medical insurance. With medical inflation projected at 9.8% in 2025 and premiums soaring 55% over three years (2021–2024), employers face escalating costs and evolving employee needs. At EverBright Actuarial Consulting Limited, we analyze the latest trends in group medical insurance claims and premiums, offering strategies to help businesses optimize their benefits programs.

The Group Medical Insurance Claims and Premium Landscape: A Growing Challenge

The claims ratio—the ratio of paid claims to premium income—is a key indicator of insurers’ financial performance.

For Hong Kong’s Accident & Health (A&H) business, including group medical insurance, the claims ratio rose from 58.9% in 2021 to 64.1% in 2023, driven by increased medical service demand, latent post-pandemic claims, and high-cost treatments for conditions like cancer and cardiovascular diseases, according to Insurance Authority data.

In 2024, the first half saw a dip to 58.5% due to improved claims management, but the projected 2025 ratio of 62% reflects ongoing pressure from medical inflation and demand for mental health and alternative therapies.

Premiums have surged significantly. The “Hong Kong Employee Medical Insurance Index” by PolyU CPCE and GUM reports a 55% cumulative increase in group medical insurance premiums from 2021 to 2024, with the premium index rising from 182 to 282.

This growth is fueled by a 102% surge in outpatient demand and a 45% increase in inpatient demand over the same period, driven by post-pandemic health awareness and an aging workforce.

Year | Claims Ratio (%) | Premium Index | Key Factors |

2021 | 58.9% | 182 | Lower utilization during pandemic |

2022 | 61.0% | 210 | Surge in claims, underwriting losses |

2023 | 64.1% | 250 | Latent claims, 12.2% premium growth |

2024* | 58.5% | 282 | Improved claims, 12.5% premium growth |

2025* | 62.0% | 310* | 9.8% medical inflation, diverse needs |

*2024 data for first half; 2025 data projected. Premium index for 2025 estimated based on trends.

Shifting Claims and Utilization Patterns

From 2021 to 2024, group medical insurance claims grew steadily, with hospitalization claims dominating at 62–70% of total claims, per data from Manulife Hong Kong and Blue Cross Insurance.

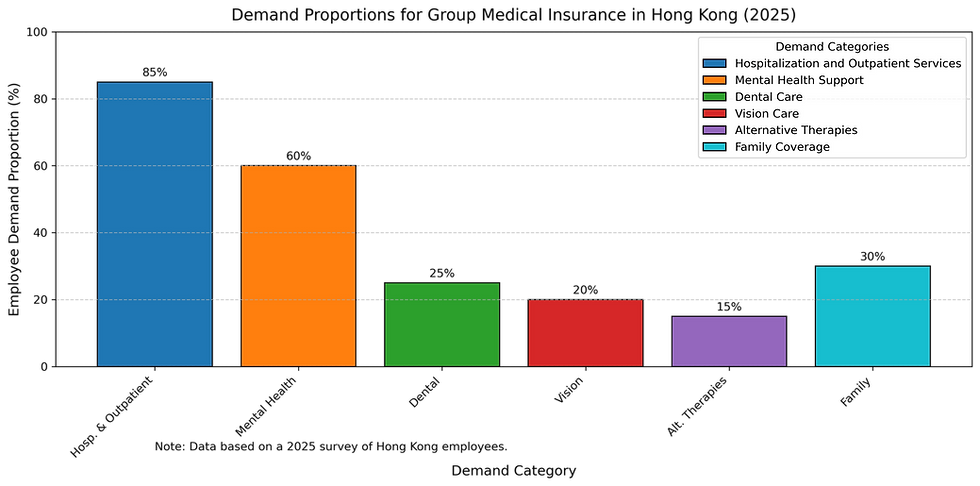

These are driven by high-cost treatments like cancer (35%) and cardiovascular care (20%). Outpatient claims, making up 26–42%, are frequent but lower in cost, led by respiratory conditions (30%) and mental health services (20%). Mental health claims are projected to reach 10% of total claims in 2024, reflecting heightened post-pandemic demand.

Utilization rates highlight the intensity of demand. Outpatient visits surged by 102% and inpatient admissions by 45% from 2021 to 2024. Younger employees (aged 18–34) drive outpatient claims, particularly for mental health and alternative therapies like traditional Chinese medicine.

In 2023, group medical insurance policies saw an average of 3.5 outpatient claims per employee annually, up from 2.1 in 2021, while inpatient claims averaged 0.3 per employee, reflecting the high cost but lower frequency of hospitalizations.

Year | Hospitalization Claims (%) | Outpatient Claims (%) | Mental Health Claims (%) | Avg. Outpatient Claims per Employee |

2021 | 70% | 22% | 5% | 2.1 |

2022 | 68% | 23% | 6% | 2.7 |

2023 | 65% | 25% | 8% | 3.5 |

2024* | 62% | 26% | 10% | 4.0* |

*Projected data.

Inpatient vs. Outpatient: Cost and Disease Breakdown

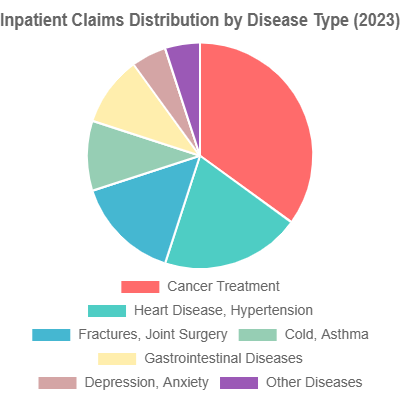

Inpatient Claims: High-value claims, with a 2023 claims ratio of 70.5%, are driven by costly procedures like cancer surgeries (35%), cardiovascular treatments (20%), and orthopedic surgeries (15%). A single cancer surgery in Hong Kong’s private hospitals can cost hundreds of thousands of HKD.

Medical inflation, projected at 9.8% for 2025, will push the inpatient claims ratio to 72%, as demand for complex treatments grows.

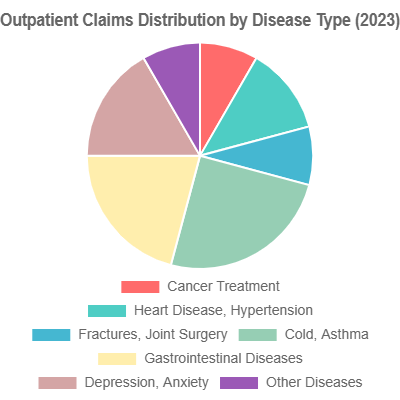

Outpatient Claims: These high-frequency, lower-cost claims had a 2023 claims ratio of 55.2%.

Digital claims systems enhance efficiency, but rising demand for mental health support (20%) and alternative therapies (e.g., traditional Chinese medicine, 15% in 2025 projections) will increase the 2025 claims ratio to 56.5%.

Outpatient services, including specialist consultations and treatments for respiratory conditions (30%), are particularly popular among younger employees.

Category | 2023 Claims Ratio | 2025 Projected Ratio | Key Drivers |

Inpatient | 70.5% | 72.0% | Cancer (35%), cardiovascular (20%) |

Outpatient | 55.2% | 56.5% | Respiratory (30%), mental health (25%) |

Claims by Disease Type (2023)

Disease Type | Inpatient Claims Ratio (%) | Outpatient Claims Ratio (%) |

Cancer | 35% | 10% |

Cardiovascular | 20% | 15% |

Orthopedic | 15% | 10% |

Respiratory | 10% | 30% |

Digestive | 10% | 25% |

Mental Health | 5% | 20% |

Premium Trends and Cost Pressures

Premiums for group medical insurance have risen sharply due to increased utilization and medical inflation.

In 2023, A&H business premiums grew by 12.2%, but underwriting profits declined due to high claims ratios. In 2024, premiums grew by 12.5%, with underwriting profits rebounding by 95.4% due to reserve releases. For a typical mid-sized company (100 employees), annual group medical premiums rose from approximately HKD 1.2 million in 2021 to HKD 1.8 million in 2024, reflecting the 55% premium index increase.

Looking to 2025, premiums are expected to rise further, driven by medical inflation and demand for broader coverage, including mental health and preventive care. Employers face the challenge of balancing comprehensive benefits with cost control, making strategic plan design critical.

Strategies for Employers

To manage rising claims and premium costs while meeting employee expectations, employers can adopt the following strategies:

Tailored Plan Design: Customize plans to cover high-cost inpatient care and growing outpatient needs, such as mental health and preventive services.

Leverage Technology: Implement telemedicine and digital claims platforms to reduce outpatient costs and improve access.

Promote Wellness: Invest in mental health programs and preventive care to lower long-term claims.

Data-Driven Optimization: Analyze claims and utilization data to refine plan structures, negotiate with insurers, and benchmark against industry standards.

Partner with EverBright for Smarter Group Medical Solutions

Navigating Hong Kong’s complex group medical insurance market requires expertise and innovation. EverBright Actuarial Consulting Limited, with our actuarial consulting and licensed brokerage services, is your trusted partner.

Our team designs data-driven insurance plans that optimize costs, enhance employee well-being, and ensure compliance. Through our Hong Kong subsidiary, holding Life and General Insurance broker licenses, we offer tailored group medical, life, and bespoke policies, including access to telemedicine, mental health support, and discounted outpatient networks.

Since 2014, we’ve empowered businesses to create competitive, sustainable benefits packages that attract and retain top talent. Contact us at info@ebactuary.com or via our online form to discover how EverBright can transform your group medical insurance strategy, delivering value and fostering a healthier, more engaged workforce.

Comments