Navigating Rising Costs and Diverse Needs in Hong Kong's Group Medical Insurance Landscape

- EverBright Actuarial

- Jul 20, 2025

- 8 min read

Updated: Jul 21, 2025

Hong Kong, a global financial hub renowned for its fast-paced environment and high cost of living, presents unique challenges for companies seeking to provide comprehensive benefits to their employees. Among these, group medical insurance stands out as a critical component of employee well-being and talent retention. However, the rising cost of premiums coupled with the increasingly diverse healthcare needs of the workforce creates a complex balancing act for employers.

The Upward Trend of Group Medical Insurance Premiums

The escalating cost of medical insurance in Hong Kong has been a persistent concern for businesses. Several factors contribute to this upward trend, including an aging population, the relentless march of medical inflation, and a growing expectation for more comprehensive coverage. The impact of these forces is clearly reflected in the Medical Premium Index, as illustrated in Table 1.

Table 1: Medical Premium Index (2006–2024)

Year | Premium Index | Annual Growth Rate (%) |

2006 | 100 | - |

2010 | 130 | 7.3% |

2015 | 165 | 5.4% |

2020 | 182 | 3.6% |

2021 | 210 | 15.4% |

2022 | 240 | 14.3% |

2023 | 265 | 10.4% |

2024 | 282 | 6.4% |

Note: 2006 is the base year with an index of 100. The growth rate represents the average annual increase.

As the data reveals, medical premium costs have steadily climbed since 2006. While the growth rate experienced some moderation between 2015 and 2020, the years following the pandemic saw a significant surge, with double-digit increases in 2021 and 2022. Though the growth has slowed down in the recent years, the overall trend points towards sustained pressure on companies to manage their healthcare expenses.

Per Capita Expenditure: A Breakdown by Employee Level

The financial burden of group medical insurance is further highlighted by examining the per capita premium expenditure. According to a 2023 survey by Howden Hong Kong, the average per capita premium is approximately HKD 7,000, marking a 10% increase from the previous year.

This figure, however, masks the considerable variations in premium costs based on employee level, company size, and the scope of coverage.

As detailed in Table 2, premium expenditures differ significantly across different employee tiers:

Table 3: Proportion of Per Capita Group Medical Insurance Premium Expenditure Ranges (2023)

Employee Level | Premium Range (HKD/Year) | Proportion (%) | Main Coverage Features |

Senior Management | 12,000–20,000 | 20% | Private ward, international medical services, comprehensive outpatient care |

Middle Management | 7,000–12,000 | 35% | Semi-private ward, outpatient care, dental/mental health |

Entry-Level Employees | 3,000–7,000 | 45% | Standard ward, basic outpatient care, preventive care |

Note: Data is based on the 2023 Howden Hong Kong survey, reflecting the distribution of group medical insurance premiums in Hong Kong companies.

Senior management, comprising 20% of the workforce, command the highest premium costs, ranging from HKD 12,000 to HKD 20,000 per year. This reflects their comprehensive coverage, including access to private wards and international medical services. Middle management, accounting for 35% of employees, fall within a premium range of HKD 7,000 to HKD 12,000, typically covering semi-private wards and comprehensive outpatient services. Entry-level employees, who constitute the largest segment (45%) of the workforce, have premiums ranging from HKD 3,000 to HKD 7,000, providing standard ward stays and basic outpatient services.

This stratified system of coverage reflects the varying needs and expectations of different employee groups, but it also underscores the financial complexities involved in providing adequate healthcare benefits across the entire organization.

The Evolving Demands of a Diverse Workforce

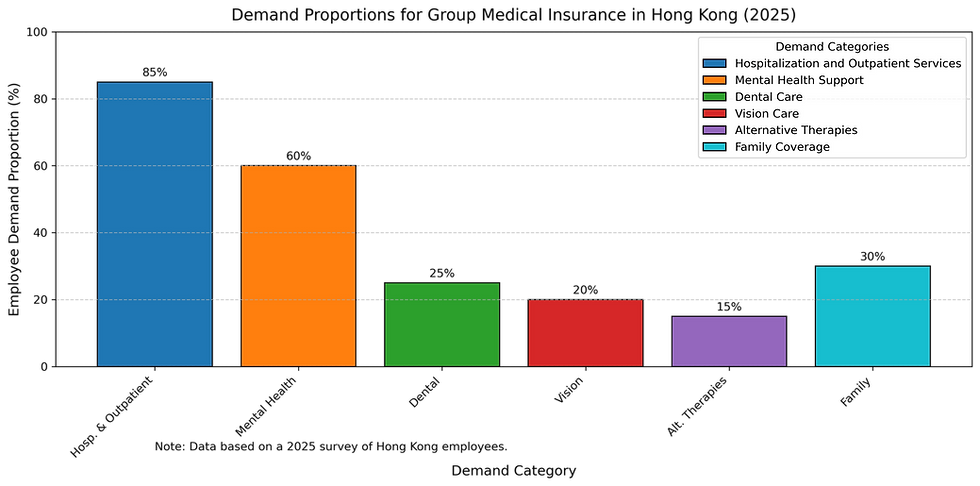

Adding another layer of complexity, Hong Kong's diverse workforce presents a wide range of healthcare needs that extend beyond traditional medical coverage. As highlighted in a 2024 market survey, employees increasingly prioritize mental health support, dental and vision care, and alternative therapies in addition to hospitalization and outpatient services.

Traditional Coverage: Still a Priority

Hospitalization and outpatient services remain the cornerstone of employee healthcare expectations, with approximately 85% of employees prioritizing coverage in these areas. The high cost of private healthcare in Hong Kong makes comprehensive coverage for surgeries, ward fees, and specialist consultations a necessity for many employees.

Mental Health: A Growing Concern

The rising prevalence of workplace stress has fueled a significant demand for mental health support. An AXA mental health report from 2025 revealed that a staggering 80% of Hong Kong employees report stress levels exceeding the global average.

This heightened stress is driving demand for services such as Employee Assistance Programs (EAPs) and subsidized psychotherapy. Notably, younger employees (aged 18–34) are particularly keen on mental health support, with 70% expressing interest.

Dental and Vision Care: Essential for White-Collar Workers

Dental and vision care are emerging as important priorities, particularly among white-collar professionals who spend a significant portion of their day working on computers.

Approximately 25% of employees desire coverage for dental checkups and treatments, while 20% seek vision checkups and eyewear coverage. These benefits are increasingly seen as essential for maintaining overall well-being and productivity.

Alternative Therapies (TCM): Expanding Healthcare Options

Alternative therapies such as Traditional Chinese Medicine (TCM), acupuncture, and chiropractic care are gaining popularity in Hong Kong.

A 2021 survey by Hong Kong Baptist University found that 60% of residents have used TCM or alternative therapies. Consequently, 15% of employees now seek insurance coverage for these treatments, reflecting a growing acceptance of holistic healthcare approaches.

Family Coverage: A Key Factor for Employees with Dependents

Family coverage, encompassing spouses and children, is a significant consideration for approximately 20% of employees, particularly those with dependents.

The availability of family coverage can be a deciding factor for employees when choosing between different employers, as it provides crucial financial security for their loved ones' healthcare needs.

The shifting landscape of employee healthcare needs is summarized in Table 3, which illustrates the demand proportions for various categories of group medical insurance benefits:

Table 3: Survey on Demand Proportions for Group Medical Insurance Among Hong Kong Employees (2025)

Demand Category | Employee Demand Proportion (%) | Remarks |

Hospitalization and Outpatient Services | 85% | Includes surgeries, ward fees, specialist consultations, etc. |

Mental Health Support | 60% | Employee Assistance Programs (EAP), virtual psychotherapy; demand reaches 70% among employees aged 18–34 |

Dental Care | 25% | Dental checkups and treatments, particularly valued by white-collar employees |

Vision Care | 20% | Vision checkups and eyewear expenses |

Alternative Therapies | 15% | Traditional Chinese medicine, acupuncture, chiropractic care, etc. |

Family Coverage | 30% | Medical coverage for spouses and children |

Note: The data is based on a 2025 survey of Hong Kong employees' group medical insurance demands.

The Challenge of Balancing Diverse Needs and Rising Costs

The diversification of employee needs has significantly increased the complexity of group medical insurance plan design. Employers face the challenge of creating plans that cater to a wide range of preferences and priorities while remaining financially sustainable. Younger employees often prioritize mental health and preventive care, while older employees tend to focus on hospitalization and chronic disease management.

A 2023 report by the Consumer Council highlighted that 35% of companies struggle to effectively balance the health needs of different age groups within their workforce. Furthermore, post-pandemic expectations for premium coverage, such as access to private wards, have risen, further contributing to the upward pressure on costs.

Examples of Employer Strategies and Plan Design Innovations

To navigate these challenges, Hong Kong employers and insurance providers are adopting various strategies:

Flexible Benefit Plans (Cafeteria Plans): Some companies are moving away from one-size-fits-all plans and implementing flexible benefit schemes.

For example, a tech company might offer employees a set of points to allocate across different benefit modules, such as enhanced dental coverage, increased mental health support sessions, or a higher tier of vision care.

This allows employees to customize their coverage based on their individual needs and preferences, promoting satisfaction and perceived value.

Wellness Programs and Preventive Care Incentives: Employers are investing in wellness programs that promote healthy lifestyles and encourage preventive care.

A financial institution, for instance, might offer subsidized gym memberships, smoking cessation programs, or on-site health screenings. They might also incentivize employees to undergo regular check-ups by reducing their deductible or co-payment for certain medical services.

The goal is to reduce overall healthcare utilization and costs by preventing illness and promoting early detection.

Tiered Coverage Options with Varying Deductibles and Co-payments: Offering different tiers of coverage allows employees to choose a plan that aligns with their budget and risk tolerance.

A multinational corporation might offer three tiers: a basic plan with a higher deductible and co-payment for employees who rarely use medical services, a mid-range plan with more comprehensive coverage at a moderate cost, and a premium plan with minimal out-of-pocket expenses for those who value extensive access to care.

Direct Contracting with Healthcare Providers: Some larger companies are exploring direct contracting with hospitals and clinics to negotiate preferential rates and improve service quality.

A large retail chain, for example, might negotiate a discounted rate for all its employees at a specific network of hospitals and clinics in exchange for a guaranteed volume of patients. This can lead to significant cost savings and better coordination of care.

Telemedicine and Virtual Care: Utilizing telemedicine and virtual care platforms can improve access to healthcare services, particularly for mental health and routine consultations.

A law firm might provide its employees with access to a virtual mental health platform where they can connect with therapists and counselors remotely. This reduces the need for in-person visits and provides convenient access to mental health support.

Negotiating with Insurers and Exploring Alternative Funding Arrangements: Employers are actively negotiating with insurance providers to secure competitive rates and exploring alternative funding arrangements, such as self-insurance or captive insurance.

A manufacturing company establish a captive insurance company to cover a portion of its employee healthcare costs, allowing it to retain more control over its healthcare spending and potentially reduce premiums in the long run.

Navigating the Future of Group Medical Insurance in Hong Kong

In conclusion, Hong Kong companies face a multifaceted challenge in managing group medical insurance. The combination of rising premium costs and the increasingly diverse healthcare needs of employees necessitates a strategic and innovative approach. Employers must carefully consider the following factors:

Plan Design: Tailoring plans to meet the specific needs of different employee segments while optimizing cost-effectiveness.

Cost Management: Exploring strategies to control premium costs, such as negotiating with insurers, implementing wellness programs, and promoting preventive care.

Employee Engagement: Educating employees about the value of their benefits and encouraging them to utilize resources effectively.

Technology Adoption: Leveraging technology to streamline administration, improve access to care, and enhance the employee experience.

Group Medical Insurance Solutions by EverBright

Hong Kong businesses face rising costs and diverse employee healthcare needs, making group medical insurance a complex challenge. EverBright Actuarial Consulting Limited, with its expert consulting and licensed broker services, delivers tailored solutions to optimize coverage, control costs, and enhance employee well-being. Our unique blend of actuarial insight and brokerage expertise ensures your benefits package attracts top talent while remaining cost-effective.

Our Services

Custom Plan Design: We craft group medical plans tailored to your workforce, balancing comprehensive coverage with affordability.

Cost Optimization: Our team negotiates with insurers, promotes wellness programs, and leverages data to manage premiums effectively.

Enhanced Employee Benefits: We secure access to telemedicine, mental health support, and discounted outpatient networks for better care and convenience.

Data-Driven Insights: Using advanced analytics, we optimize plan design and benchmark against industry standards to ensure competitiveness.

Streamlined Administration: Our brokers handle enrollment, claims, and employee communication, freeing your HR team for strategic priorities.

Why Choose EverBright?

Actuarial Expertise: Our actuaries provide data-driven strategies for sustainable, high-value insurance plans.

Licensed Brokerage: As a licensed Life and GI broker in Hong Kong, we offer end-to-end support, from plan selection to implementation.

Employee-Centric Solutions: We prioritize mental health, virtual care, and affordable access to enhance employee satisfaction.

Proven Results: Since 2014, we’ve helped businesses create healthier, more engaged workforces while maximizing benefits value.

Get Started Today

Partner with EverBright Actuarial Consulting to transform your group medical insurance strategy. Contact us at info@ebactuary.com or via our online form to create a competitive, sustainable benefits package that empowers your workforce.

Comments