Study on China's New Policy on Predetermined Interest Rates for Life Insurance and Its Market Impact (2025)

- EverBright Actuarial

- Jul 26, 2025

- 4 min read

Updated: Jul 27, 2025

In January 2025, China's insurance regulators introduced a dynamic adjustment mechanism for predetermined interest rates (also known as scheduled or assumed interest rates) in life insurance products, linking them to market interest rates for quarterly reviews.

This policy aims to mitigate risks from interest rate spreads amid declining bond yields and economic pressures. On July 25, 2025, the Insurance Association of China announced a research value of 1.99%, formally triggering the first downward adjustment.

This study examines the policy details, the adjustment mechanism, market impacts, and reactions from major insurers such as China Life Insurance, Ping An Life Insurance, and others, with comparisons highlighting insurer-specific responses.

Policy Details and Adjustments

The new policy requires predetermined interest rates for life insurance products to be dynamically adjusted based on a quarterly "research value" calculated by the Insurance Association of China. This value reflects market interest rates and the industry's asset-liability conditions.

The mechanism was triggered after two consecutive quarters where the current caps exceeded the research value by 25 basis points (bp) or more. As a result, insurers must switch products and discontinue old ones by August 31, 2025, to comply with lower caps.

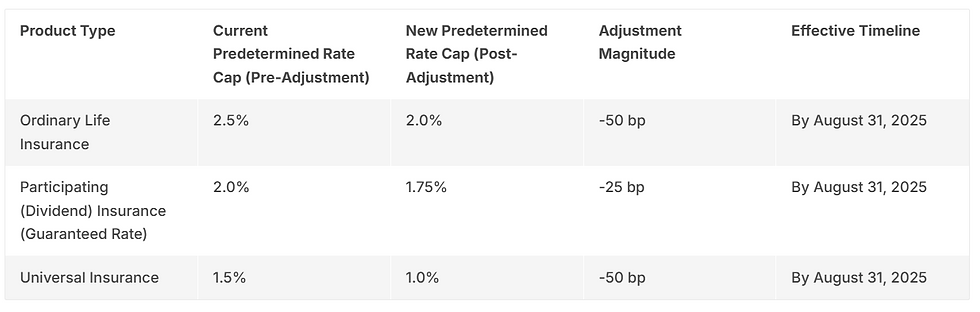

The table below summarizes the rate adjustments across product types.

Product Type | Current Predetermined Rate Cap (Pre-Adjustment) | New Predetermined Rate Cap (Post-Adjustment) | Adjustment Magnitude | Effective Timeline |

Ordinary Life Insurance | 2.5% | 2.0% | -50 bp | By August 31, 2025 |

Participating (Dividend) Insurance (Guaranteed Rate) | 2.0% | 1.75% | -25 bp | By August 31, 2025 |

Universal Insurance | 1.5% | 1.0% | -50 bp | By August 31, 2025 |

These adjustments align with the policy's rule that rates must be in multiples of 0.25%, and the research value of 1.99% (down from previous quarters) necessitated the cuts to prevent negative spreads.

Adjustment Mechanism

The research value is determined by three key market interest rate indicators and the overall asset-liability situation in the insurance industry.

Adjustments occur if the current cap exceeds the research value by ≥25 bp for two consecutive quarters. The latest value of 1.99% (Q2 2025) followed a similar low in Q1, triggering the mechanism.

The table below outlines the key indicators influencing the research value, with recent data as of July 2025.

Indicator | Description | Recent Value (July 2025) | Trend Impact |

5-Year+ Loan Prime Rate (LPR) | Benchmark lending rate for long-term loans, reflecting borrowing costs. | 3.35% (down from 3.85% in Jan 2025) | Declining, pressuring downward adjustments. |

5-Year Fixed Deposit Rate | Rate on long-term bank deposits, indicating savings yields. | ~2.0% (average, down ~50 bp YTD) | Low yields reduce insurer investment returns. |

10-Year Treasury Yield | Yield on government bonds, a proxy for risk-free rates. | 1.6% (down 80 bp since March 2024) | Sharp decline exacerbates spread risks. |

Industry asset-liability factors include solvency ratios and investment performance, with insurers facing pressure from low yields (e.g., 10-year bonds at 1.6%).

Market Impact

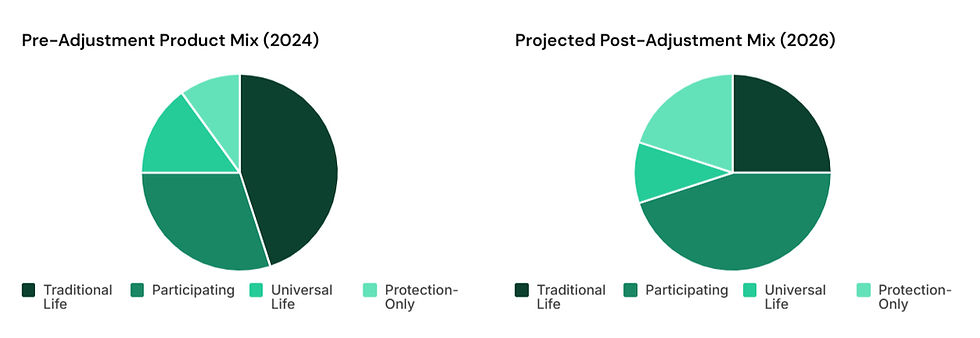

The rate cuts are expected to have multifaceted impacts on China's life insurance market, valued at approximately RMB 4.5 trillion in premiums (2024). Lower rates will reduce product attractiveness, potentially slowing new business value (NBV) growth, but encourage a shift to participating and protection-oriented products.

A pre-adjustment sales rush is anticipated, boosting short-term premiums but leading to a post-August slowdown. Profitability may suffer from compressed spreads, with investment yields projected at 3–4% in 2025, down from 4–5% in 2024. However, this could stabilize the industry by reducing liability costs amid economic challenges like property sector woes and U.S. tariffs.

Longer-term, the policy promotes sustainability, with forecasts indicating a 5–7% CAGR in life premiums through 2030, down from 8–10% pre-policy. EV adoption in insurance (e.g., tech-driven underwriting) may accelerate to offset margins.

Insurers' Feedback and Reactions on Predetermined Interest Rates

Major insurers have responded by announcing product adjustments and strategic shifts. China Life and Ping An, the largest players, issued notices on July 25, 2025, confirming rate cuts for new filings.

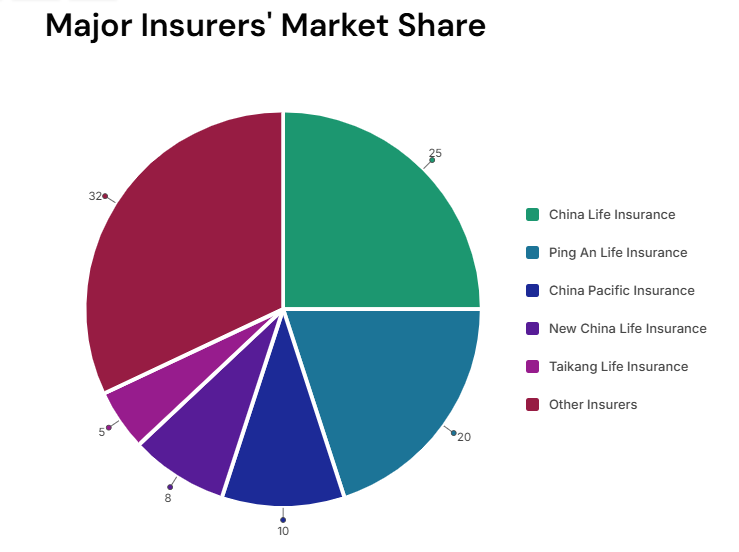

Reactions vary: Larger firms like Ping An express optimism via diversification, while others highlight growth challenges. The table below compares feedback from key insurers, based on announcements and analyst reports.

Insurer | Market Share (2024 Premiums) | Reaction/Announcement | Strategic Response | Projected Impact on 2025 Growth |

China Life Insurance | ~25% | Announced adjustment of max rates for new products; expects "sufficient capital" for 2025. | Shift to participating products; focus on non-life growth amid regulations. | Slower NBV (5–7%); stable solvency. |

Ping An Life Insurance | ~20% | Confirmed rate cuts; optimistic on market despite lower outlook (investment return cut). | Diversify into health/protection; leverage AI for efficiency; "strong beta" expected. | Moderate growth (6–8%); resilient via non-insurance arms. |

China Pacific Insurance | ~10% | No formal announcement yet; analysts predict compliance by August. | Enhance equity investments post-capital charge reductions; focus on asset management. | Potential slowdown (4–6%); profitability pressure. |

New China Life Insurance | ~8% | Expressed concerns over spreads; planning product switches. | Increase participating share to mitigate risks; invest in equities. | Lower growth (3–5%); focus on risk management. |

Taikang Life Insurance | ~5% | Neutral response; aligning with policy for long-term stability. | Accelerate digital transformation; emphasize protection products. | Steady (5%); minimal short-term disruption. |

Insurers like Ping An highlight "optimism" through broader portfolios, while China Life focuses on capital adequacy. Smaller players may face greater challenges, with potential consolidation.

Conclusion

China's 2025 predetermined interest rate policy marks a proactive step toward aligning life insurance with market realities, triggered by a 1.99% research value and declining rates. While short-term market disruptions (e.g., product rushes and premium slowdowns) are likely, the adjustments foster long-term stability by curbing spread risks.

Insurers' reactions underscore a shift to diversified, lower-guarantee products, with leaders like Ping An and China Life adapting resiliently. Ongoing monitoring of market indicators will be crucial, as further cuts could occur if yields remain low. This policy enhances industry sustainability but may temper growth amid broader economic headwinds.

Everbright Actuarial Consulting and Broker Services specializes in helping insurers navigate regulatory changes. Our expert team offers actuarial modeling, risk assessment, and strategic brokerage solutions to optimize product adjustments, enhance profitability, and ensure compliance. Contact Everbright at info@ebactuary.com to adapt your life insurance strategies for a resilient future.

Comments